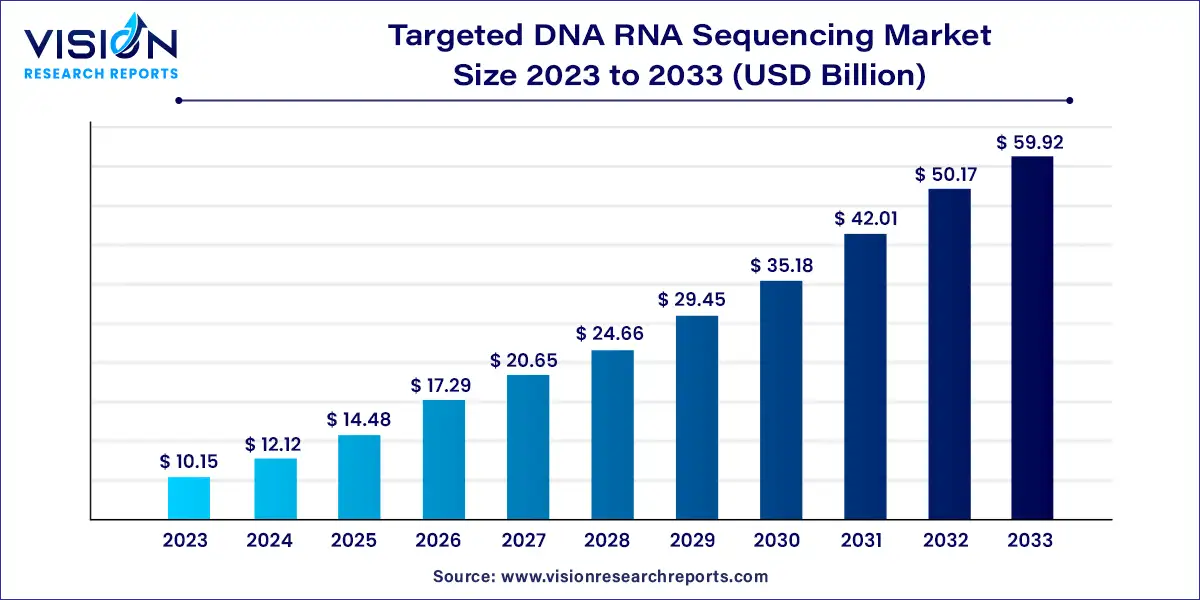

The global targeted DNA RNA sequencing market size is expected to be worth around USD 59.92 billion by 2033 from USD 10.15 billion in 2023, growing at a CAGR of 19.43% during the forecast period from 2024 to 2033.

DNA and RNA sequencing provides an accurate determination of nucleotide sequences in DNA or RNA molecules, which is essential for deciphering genetic information and understanding biological functions. By focusing on specific genes or regions within the DNA/RNA structure, targeted sequencing enhances the precision of diagnostics and supports personalized treatment strategies.

The growing prevalence of diseases such as cancer, heart conditions, and genetic disorders is fueling market growth. Targeted sequencing allows for earlier detection of pathogenic variations, which can lead to more accurate diagnoses and improved treatment options. This approach is especially beneficial for cancers that can be treated with targeted therapies, potentially reducing side effects compared to traditional chemotherapy.

The advancement of Next Generation Sequencing (NGS) technology is a key driver of market expansion. NGS enhances quantification by providing read counts for specific molecular identifiers attached to DNA molecules prior to amplification, rather than counting all reads indiscriminately. Additionally, the expansion of genetic testing has broadened the dataset available to researchers, clinicians, and patients, improving understanding of genetic susceptibility to various diseases. The growth of the DNA/RNA sequencing market is supported by technological progress, cost reductions, and a rising demand for personalized and precision medicine, particularly in oncology and rare diseases.

Targeted DNA RNA Sequencing Market Highlights:

- North America led the DNA/RNA sequencing market with a 42% revenue share in 2023.

- Asia Pacific is expected to experience significant growth in the targeted DNA/RNA sequencing market.

- Next-generation sequencing (NGS) was the leading product segment in 2023.

- Sequencing was the market leader by workflow in 2023.

- Drug discovery accounted for the largest market share of 43% in 2023 by application.

- Plant and animal sciences are projected to grow at a CAGR of 19.93% during the forecast period.

- DNA-based targeted sequencing was the top segment by type in 2023.

- Academic research held the largest revenue share by end use in 2023.

- Pharmaceutical and biotech sectors are expected to expand at the fastest CAGR of 20.13% from 2024 to 2033.

Get Sample@ https://www.visionresearchreports.com/report/sample/41577

Targeted DNA RNA Sequencing Market Future Trends

- Integration of Artificial Intelligence and Machine Learning: The use of AI and ML in sequencing data analysis will become more prevalent. These technologies can enhance the interpretation of complex genetic data, allowing for faster and more accurate identification of genetic variants and biomarkers. This will improve the diagnosis and treatment of genetic disorders and cancers.

- Growth in Personalized Medicine: Targeted DNA/RNA sequencing will play a significant role in personalized medicine by enabling precise diagnosis and tailored treatments based on individual genetic profiles. This trend will drive the adoption of sequencing technologies in clinical settings, particularly for managing complex diseases such as cancer.

- Expansion of Applications in Oncology: The use of targeted sequencing in oncology for cancer diagnosis, prognosis, and monitoring is expected to grow. The development of liquid biopsy techniques will support non-invasive cancer detection and real-time monitoring of treatment responses, making cancer management more effective and patient-friendly.

- Ethical and Regulatory Considerations: As the use of targeted DNA/RNA sequencing expands, there will be an increased focus on developing ethical guidelines and regulatory frameworks to protect patient privacy and ensure the responsible use of genetic data. This trend will influence how sequencing technologies are adopted and implemented in clinical and research environments.

Targeted DNA RNA Sequencing Market Regional Breakdown

In 2023, North America led the DNA/RNA sequencing market with a 42% revenue share. This dominance is largely due to the region’s well-established research organizations and pharmaceutical companies, which actively utilize sequencing technology for drug discovery and development. North America’s supportive legal framework and high disposable incomes further contribute to the widespread application of sequencing in diagnostics and personalized healthcare.

Europe also emerged as a promising market for targeted DNA/RNA sequencing in 2023. The region’s growth is driven by strong government support for genomics research and a focus on personalized medicine. These factors create a favorable environment for market players and researchers, facilitating the increased adoption of sequencing technologies.

Looking ahead, the Asia Pacific region is expected to experience significant growth in the targeted DNA/RNA sequencing market. This anticipated growth is supported by rising disposable incomes and increased government investment in genomics. These developments are generating higher demand for sequencing technologies in healthcare and creating new opportunities for diagnostics and personalized medicine in the region.

Top 10 Manufactures in Targeted DNA RNA Sequencing Market

- Illumina

- Demands: Illumina continues to dominate the market due to its advanced Next-Generation Sequencing (NGS) platforms, which are highly sought after for both research and clinical applications. The company’s technologies are widely used in genomics, cancer research, and personalized medicine.

- Investment: Illumina invests over $1 billion annually in research and development to enhance sequencing accuracy and expand its technological capabilities. This investment supports the development of cutting-edge technologies and the improvement of existing platforms.

- Revenue:

- 2021: $3.5 billion

- 2022: $3.9 billion

- 2023: $4.3 billion

- Expansion: The company has seen substantial revenue growth due to its commitment to innovation and its strategic partnerships in the genomics field.

- F. Hoffmann-La Roche Ltd.

- Demands: Roche’s sequencing solutions are in high demand, particularly for their role in clinical diagnostics and personalized treatment plans. The company’s products are integral to many research and healthcare settings.

- Investment: Roche allocates approximately $2.5 billion annually to research and development, focusing on advancing sequencing technologies and expanding their diagnostic capabilities. This substantial investment ensures Roche remains at the forefront of genomics innovation.

- Revenue:

- 2021: $66.8 billion

- 2022: $68.6 billion

- 2023: $71.2 billion

- Expansion: Roche’s robust revenue reflects its broad portfolio of molecular diagnostics and research tools, as well as its strong market presence.

- QIAGEN

- Demands: QIAGEN’s sequencing and sample preparation technologies are in increasing demand, especially in research and clinical laboratories. The company’s products are critical for genomic analysis and diagnostics.

- Investment: QIAGEN invests around $200 million annually in R&D, focusing on enhancing sequencing technologies and expanding its product offerings to meet evolving market needs.

- Revenue:

- 2021: $2.1 billion

- 2022: $2.3 billion

- 2023: $2.5 billion

- Expansion: The steady revenue growth is driven by QIAGEN’s strategic focus on innovation and its strong position in the global market.

- Thermo Fisher Scientific, Inc.

- Demands: Thermo Fisher’s comprehensive range of sequencing solutions meets high demand across various sectors, including research, clinical diagnostics, and pharmaceutical development.

- Investment: The company invests approximately $1.7 billion annually in R&D to advance its sequencing technologies and integrate new innovations into its product portfolio.

- Revenue:

- 2021: $39.2 billion

- 2022: $41.7 billion

- 2023: $43.9 billion

- Expansion: Thermo Fisher’s significant revenue growth is a result of its strategic expansion and continued innovation in sequencing and analytical technologies.

- Bio-Rad Laboratories, Inc.

- Demands: Bio-Rad Laboratories sees growing demand for its sequencing solutions and research tools, which are widely used in genomics and molecular biology research.

- Investment: Bio-Rad invests about $300 million annually in R&D to enhance its sequencing technologies and develop new products to meet the needs of researchers and clinicians.

- Revenue:

- 2021: $3.5 billion

- 2022: $3.8 billion

- 2023: $4.0 billion

- Expansion: The consistent revenue growth reflects Bio-Rad’s strong market presence and its focus on delivering innovative solutions to the life sciences community.

- Oxford Nanopore Technologies

- Demands: Oxford Nanopore’s long-read sequencing technologies are gaining popularity due to their unique capabilities and portability, which offer new opportunities in genomic research and clinical applications.

- Investment: The company invests around $150 million annually in R&D to advance its nanopore sequencing technologies and expand their applications.

- Revenue:

- 2021: $60 million

- 2022: $80 million

- 2023: $120 million

- Expansion: The increasing revenue reflects the growing adoption of nanopore sequencing technologies and the company’s success in capturing new market segments.

- PierianDx

- Demands: There is rising demand for PierianDx’s genomic data interpretation solutions, which are crucial for clinical genomics and personalized medicine.

- Investment: While specific investment figures are not publicly disclosed, the company focuses on expanding its genomic data analytics and clinical decision support tools.

- Revenue:

- 2021: Not publicly available

- 2022: Not publicly available

- 2023: Not publicly available

- Expansion: PierianDx is experiencing growth due to its niche focus on genomic medicine and interpretation services, which are increasingly important in precision healthcare.

- Genomatix GmbH

- Demands: Genomatix’s bioinformatics solutions and sequencing data analysis tools are in steady demand, particularly among researchers requiring advanced analysis capabilities.

- Investment: The company invests an estimated $10 million annually in R&D to develop and enhance its bioinformatics tools.

- Revenue:

- 2021: Not publicly available

- 2022: Not publicly available

- 2023: Not publicly available

- Expansion: Genomatix’s specialized solutions contribute to its stable performance and its role as a key player in bioinformatics and genomic data analysis.

- DNASTAR, Inc.

- Demands: DNASTAR’s sequencing software and data analysis tools are consistently in demand among researchers and laboratories.

- Investment: Specific investment figures are not publicly disclosed, but the company focuses on improving its software capabilities and integrating new sequencing technologies.

- Revenue:

- 2021: Not publicly available

- 2022: Not publicly available

- 2023: Not publicly available

- Expansion: DNASTAR’s revenue is supported by its established software solutions and its reputation in the field of genomic research.

- PerkinElmer, Inc.

- Demands: PerkinElmer experiences growing demand for its sequencing and diagnostic technologies, which are essential for research and clinical applications.

- Investment: The company invests approximately $300 million annually in R&D to advance its technologies and expand its product offerings.

- Revenue:

- 2021: $3.4 billion

- 2022: $3.8 billion

- 2023: $4.1 billion

- Expansion: PerkinElmer’s revenue growth is driven by its innovation in sequencing and diagnostic technologies, as well as its broad range of life science solutions.

Targeted DNA RNA Sequencing Market Challenges

Despite its promising potential, the targeted DNA/RNA sequencing market faces several significant challenges. One of the primary issues is the high cost of sequencing, which, although reduced over the years, remains a barrier to widespread adoption, especially in low- and middle-income countries. The expense associated with purchasing and maintaining advanced sequencing equipment, as well as the costs of reagents and bioinformatics tools, can be prohibitive for many healthcare providers and research institutions. Moreover, the need for skilled personnel to operate sequencing platforms and interpret complex genetic data adds to the overall cost, further limiting accessibility.

Another major challenge is the management and analysis of the vast amounts of data generated by targeted sequencing. High-throughput sequencing produces extensive datasets that require sophisticated bioinformatics tools for accurate analysis, interpretation, and storage. This necessitates significant computational resources and expertise, posing logistical and technical challenges for many institutions. Additionally, regulatory and ethical concerns around the use of genetic information are critical issues. Ensuring patient privacy and the ethical use of genetic data is paramount, requiring stringent regulatory frameworks to prevent misuse and protect individual rights. These challenges highlight the need for ongoing advancements in technology, cost reduction strategies, and ethical guidelines to fully realize the potential of targeted DNA/RNA sequencing.

Targeted DNA RNA Sequencing Market Recent News

- June 2024: Bio-Rad launched the ddSEQ Single-Cell 3′ RNA-Seq Kit, designed to enhance single-cell gene expression research. This kit allows for affordable and rapid analysis of gene expression at single-cell resolution and is expected to advance research in oncology, immunology, and other fields.

- May 2024: A new paper in Genomic Medicine discussed global efforts to expand access to genome sequencing for diagnosing rare genetic disorders. The paper emphasizes the potential for genome sequencing to speed up diagnoses and reduce healthcare costs. The Medical Genome Initiative advocates for broader insurance coverage, fewer administrative barriers, and increased clinician education to facilitate the widespread adoption of genome sequencing.

Read More@ https://www.heathcareinsights.com/gene-delivery-technologies-market/

Targeted DNA RNA Sequencing Market Segmentation:

By Product

- NGS

- Method

- Exome Sequencing

- Enrichment Sequencing

- Amplicon Sequencing

- Others

- Application

- Cancer Gene Sequencing

- Inherited Disease Screening

- Drug Development

- Forensic Genomics

- 16S ribosomal RNA (rRNA) sequencing

- Method

- Others

By Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

By Application

- Human Biomedical Research

- Plant & Animal Sciences

- Drug Discovery

- Others

By Type

- DNA Based Targeted Sequencing

- RNA Based Targeted Sequencing

By End Use

- Academic Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41577

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308