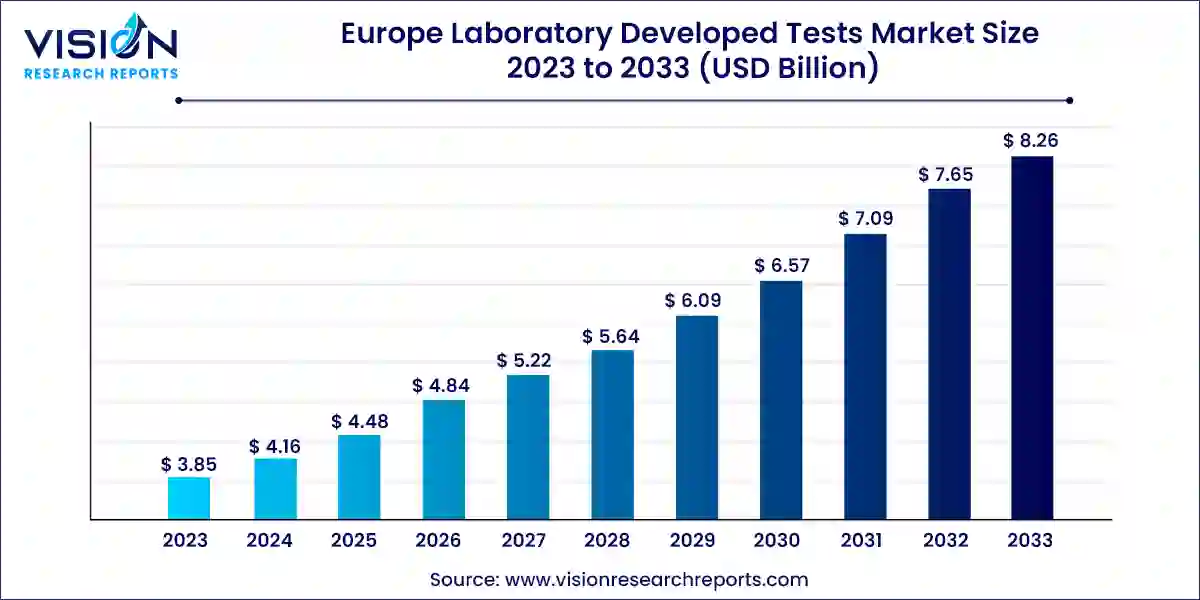

The Europe laboratory developed tests market value stood at USD 3.85 billion in 2023 and it is predicted to rise to USD 8.26 billion by 2033 with growing at a CAGR of 7.93% from 2024 to 2033.

Market growth is driven by several factors, including the rising demand for personalized medicine, the increasing prevalence of cancer, and the lack of commercial in vitro diagnostic tests for certain diseases.

Additionally, some tests do not require regulatory approvals. For example, laboratory-developed tests (LDTs) have been utilized in various countries as part of their testing strategies, especially during the COVID-19 pandemic. The World Health Organization introduced the Emergency Use Listing (EUL) procedure in 2020, which included rapid antigen tests for COVID-19. LDTs, often more affordable than registered in vitro diagnostic tests, have been crucial in creating a wide array of diagnostic tools for different health conditions. The pandemic highlighted the importance of designing, developing, and using LDTs for emergency situations.

LDTs, or ‘in-house devices,’ are exempt from in vitro diagnostic regulations if the health institution meets the conditions outlined in Article 5(5) of the Regulation. For example, in 2023, the University of Bath in England developed LoCKAmp, a prototype device for rapid and cost-effective COVID-19 detection from nasal swabs. Moreover, in January 2024, the Spanish biotech company Amadix received Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA) for PreveCol, a colorectal cancer screening blood test.

Endometriosis, a condition affecting approximately 10% (190 million) of women and girls worldwide, has often been overlooked as a public health priority. In January 2022, the French Government introduced a National Strategy for Endometriosis. For example, in June 2022, Ziwig, a startup based in Lyon, France, launched Ziwig Endotest. This non-invasive diagnostic test for endometriosis utilizes salivary miRNA analysis through next-generation sequencing and artificial intelligence.

Europe Laboratory Developed Tests Market Highlights:

- By application, the oncology segment accounted for the largest market share of 22% in 2023.

- The nutritional and metabolic disease segment is projected to experience the highest compound annual growth rate (CAGR) of 10.53% from 2024 to 2033.

- By technology, the molecular diagnostics segment held the largest market share of 27% in 2023.

Get the Sample Pages of Report for More Understanding@ https://www.visionresearchreports.com/report/sample/41390

Recent Developments and Trends in Europe Laboratory Developed Tests Market

- Growth in Oncology Testing

- The rise in cancer incidence across Europe has spurred the development of LDTs for cancer diagnostics. Laboratories are increasingly focusing on creating tests that identify specific oncogenes and biomarkers to guide targeted therapies. LDTs are particularly beneficial in liquid biopsy applications, where non-invasive testing is used to monitor tumor progression.

- Increased Focus on Infectious Disease Testing

- The COVID-19 pandemic highlighted the importance of LDTs in quickly addressing public health emergencies. Laboratories developed and deployed LDTs for rapid and specific detection of the virus. This trend is expected to continue, with growing demand for LDTs in infectious disease diagnostics, especially for emerging pathogens.

- Regulatory Changes Driving Market Transformation

- The introduction of the IVDR in Europe has impacted the LDT market by imposing stricter requirements on the development and use of these tests. Laboratories now need to comply with higher safety and performance standards, which has led to increased investment in regulatory compliance and quality control.

- Rising Collaboration Between Labs and Technology Providers

- Laboratories are increasingly collaborating with technology providers and pharmaceutical companies to develop innovative LDTs. These partnerships allow for the integration of cutting-edge technologies like artificial intelligence (AI) and machine learning, enhancing diagnostic accuracy and patient outcomes.

Europe Laboratory Developed Tests Market by Application Outlook

In 2023, the oncology segment led the market with the largest revenue share of 22%. The Laboratory Developed Tests (LDTs) market is divided into various categories, including oncology, genetic disorders/inherited diseases, infectious and parasitic diseases, immunology, endocrine, nutritional and metabolic diseases, cardiology, mental/behavioral disorders, pediatric-specific tests, hematology/general blood tests, body fluid analysis, toxicology, and other diseases. Data from the EU Science Hub reveals that new cancer cases increased by 2.3% in 2022 compared to 2020, totaling 2.74 million cases. Western and Northern EU countries report higher incidence rates, while Eastern EU countries face higher cancer mortality rates.

Pancreatic cancer, one of the four deadliest cancers, poses a significant challenge due to its late diagnosis and treatment. A report in The Lancet points out the increased risk of pancreatic cancer in Western Europe. The European PANCAID project aims to improve early detection through a blood test by identifying biomarkers for at-risk groups.

The nutritional and metabolic disease segment is anticipated to grow at the fastest compound annual growth rate (CAGR) of 10.53% during the forecast period. In Germany, neonatal screening includes 19 congenital diseases, 13 of which are metabolic disorders. The German Federal Statistical Office reported 738,819 live births and 2,345 infant deaths in 2022, with approximately one in 1,300 newborns affected by these target diseases. ZenTech LaCAR offers a variety of screening tests for rare neonatal diseases, while ARUP Laboratories’ pharma services group developed AAV5 DetectCDx, a blood test for identifying Hemophilia A patients. In December 2023, ARUP Laboratories partnered with Medicover, a European diagnostics and healthcare provider, to offer companion diagnostics for Hemophilia A gene therapy.

Europe Laboratory Developed Tests Market by Technology Outlook

The molecular diagnostics segment led the market in 2023, securing the largest revenue share of 27%. The LDT market includes segments such as immunoassays, hematology and coagulation, molecular diagnostics, microbiology, clinical chemistry, histology/cytology, flow cytometry, mass spectrometry, and others. Molecular diagnostics are crucial for detecting genetic, inherited, viral, and bacterial diseases.

The rise in lifestyle-related diseases has increased the demand for early detection methods. Cancer, a notable genetic disorder, was the second leading cause of death in Europe in 2020, with 1.2 million fatalities. In November 2023, F. Hoffmann-La Roche Ltd launched the LightCycler PRO, a next-generation qPCR system designed to enhance testing for cancer, infectious diseases, and other public health issues.

The growing prevalence of autoimmune disorders has driven demand for rapid disease detection, fueling the development of laboratory-developed tests, including immunoassay kits. Multi-parametric flow cytometry continues to be a laboratory-developed test for diagnosing leukemia and lymphoma, despite the lack of FDA approval. In October 2023, Synlab GmbH introduced myEDIT-B, the world’s first blood-based diagnostic test for bipolar disorder. Additionally, IBDSENSE, a non-invasive fluorescence-based technology developed by the University of Edinburgh, assists in diagnosing inflammatory bowel disease.

Europe Laboratory Developed Tests Market Country Outlook

The UK’s laboratory-developed tests market is projected to grow at the fastest CAGR during the forecast period, driven by an increase in long-term physical health conditions among the working population, which contributes to economic inactivity. According to the NHS, approximately 90% of the adult population in the UK is affected by type 2 diabetes.

In France, the laboratory-developed tests market is also expected to grow rapidly due to the rising number of deaths caused by non-communicable diseases (NCDs), underscoring the need for early disease detection. WHO data indicates that Alzheimer’s disease, other dementias, and ischemic heart disease were the leading causes of death in 2019.

Recent Market News

- The Innovative Health Initiative (IHI) and UK Research and Innovation (UKRI) have jointly funded the AD-RIDDLE program, aimed at developing innovative solutions for the diagnosis and treatment of Alzheimer’s disease.

- In January 2024, Qiagen NV, a Netherlands-based company specializing in diagnostic test kits, announced that the U.S. Food and Drug Administration (FDA) had granted clearance for its NeuMoDx CT/NG Assay 2.0. This assay is designed for the detection of sexually transmitted infections (STIs) in the United States.

Key Companies in the Europe Laboratory Developed Tests (LDTs) Market

1. Abbott

- Overview: Abbott is a global healthcare company known for its comprehensive portfolio of diagnostic tools and laboratory-developed tests. The company offers a range of LDTs, including those for infectious diseases, oncology, and genetic testing.

- Recent Initiatives: Abbott has been expanding its LDT offerings with innovative solutions such as next-generation sequencing and point-of-care diagnostics. The company has also focused on integrating digital health technologies to enhance testing accuracy and efficiency.

- Financial Performance: Abbott reported a robust performance in its diagnostics segment, driven by increased demand for COVID-19 testing and other LDTs. The company’s diagnostics revenue grew significantly in the last fiscal year.

2. Guardant Health

- Overview: Guardant Health specializes in advanced liquid biopsy tests for cancer detection and monitoring. Their LDTs use blood samples to provide insights into tumor genomics and guide treatment decisions.

- Recent Initiatives: Guardant Health recently expanded its product line with new genomic tests and enhanced its partnerships with oncology centers in Europe. The company is also involved in clinical trials to validate the efficacy of its tests in various cancer types.

- Financial Performance: The company has seen significant growth in its revenues, largely driven by the increasing adoption of its liquid biopsy tests in clinical settings.

3. Siemens Healthineers AG

- Overview: Siemens Healthineers offers a broad range of laboratory-developed tests, including those for clinical chemistry, immunoassay, and molecular diagnostics. The company is known for its high-quality diagnostic solutions and cutting-edge technology.

- Recent Initiatives: Siemens Healthineers has been investing in the development of integrated diagnostic solutions and expanding its portfolio with new LDTs. The company also focuses on advancing its digital health capabilities to streamline lab operations.

- Financial Performance: Siemens Healthineers reported strong financial performance with substantial revenue growth in its diagnostic and laboratory segments, supported by the rising demand for LDTs across Europe.

4. Quest Diagnostics

- Overview: Quest Diagnostics is a leading provider of diagnostic testing services, including laboratory-developed tests for a wide range of health conditions. The company’s LDTs cover areas such as oncology, cardiology, and infectious diseases.

- Recent Initiatives: Quest Diagnostics has been focusing on expanding its LDT capabilities through acquisitions and partnerships. The company is also enhancing its digital platforms to improve test accessibility and results turnaround time.

- Financial Performance: The company has experienced steady growth in its diagnostics revenues, driven by increased testing volumes and advancements in its test offerings.

5. Qiagen

- Overview: Qiagen provides molecular diagnostics and laboratory-developed tests for various applications, including cancer genomics, infectious disease detection, and genetic testing. The company is known for its expertise in PCR and next-generation sequencing technologies.

- Recent Initiatives: Qiagen has introduced several new LDTs and expanded its partnerships with research institutions. The company is also investing in enhancing its sample preparation and analysis technologies.

- Financial Performance: Qiagen has reported positive growth in its diagnostics segment, with increased revenue from its LDTs driven by strong demand in molecular diagnostics.

6. Eurofins Scientific

- Overview: Eurofins Scientific is a global group providing laboratory services, including a wide range of laboratory-developed tests for clinical diagnostics, environmental testing, and food safety. The company’s LDTs are utilized across various healthcare settings.

- Recent Initiatives: Eurofins has been expanding its service offerings through acquisitions and new laboratory setups. The company also focuses on developing innovative LDTs and enhancing its testing capabilities.

- Financial Performance: Eurofins Scientific has seen significant growth in its revenues, supported by its extensive portfolio of LDTs and the expansion of its global laboratory network.

7. Illumina, Inc.

- Overview: Illumina is a leader in next-generation sequencing technologies and offers laboratory-developed tests for genomic research and clinical diagnostics. The company’s LDTs are widely used for genetic testing and cancer genomics.

- Recent Initiatives: Illumina has been advancing its sequencing technologies and expanding its LDT portfolio with new genomic tests. The company is also focused on improving data analysis and interpretation through its digital solutions.

- Financial Performance: Illumina has reported strong financial performance, with significant revenue growth driven by its leadership in genomic sequencing and the increasing adoption of its LDTs in clinical settings.

8. F. Hoffmann-La Roche Ltd

- Overview: Roche provides a wide range of diagnostic solutions, including laboratory-developed tests for oncology, virology, and personalized medicine. The company is known for its innovative approaches in diagnostic testing.

- Recent Initiatives: Roche has introduced several new LDTs and expanded its diagnostic portfolio with advanced technologies. The company is also investing in digital health solutions and personalized medicine approaches.

- Financial Performance: Roche has seen steady growth in its diagnostics segment, driven by the success of its LDTs and the continued demand for innovative diagnostic solutions.

9. SVAR Lifesciences

- Overview: SVAR Lifesciences specializes in laboratory-developed tests for various clinical applications, including infectious diseases and chronic conditions. The company focuses on providing high-quality, reliable testing solutions.

- Recent Initiatives: SVAR Lifesciences has been working on expanding its LDT portfolio and enhancing its testing capabilities through research and development. The company is also exploring partnerships to broaden its market reach.

- Financial Performance: The company has experienced moderate growth in its revenues, supported by the increasing demand for its LDTs in the European market.

10. Biomérieux

- Overview: Biomérieux is a global player in the field of in vitro diagnostics and offers a variety of laboratory-developed tests for infectious diseases, cancer, and other medical conditions. The company is known for its expertise in microbiology and molecular diagnostics.

- Recent Initiatives: Biomérieux has introduced new LDTs and expanded its diagnostic offerings to include advanced technologies for pathogen detection and molecular diagnostics. The company is also investing in digital solutions to enhance lab operations.

- Financial Performance: Biomérieux has reported positive financial performance, with growth in its diagnostics segment driven by the continued demand for its LDTs and innovative testing solutions.

Read More@ Medical Kiosk Market

Europe Laboratory Developed Tests Market Segmentation:

By Technology

- Immunoassays

- Hematology and coagulation

- Molecular diagnostics

- Microbiology

- Clinical chemistry

- Histology/Cytology

- Flow cytometry

- Mass spectroscopy

- Others

By Application

- Oncology

- Companion diagnostics

- Genomics sequencing and others

- Genetic disorders/inherited diseases

- Infectious and parasitic diseases

- Immunology

- Endocrine

- Nutritional and metabolic diseases

- Cardiology

- Mental/behavioral disorder

- Pediatrics-specific testing

- Hematology/general blood testing

- Body fluid analysis

- Toxicology

- Other diseases

By Country

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41390

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308