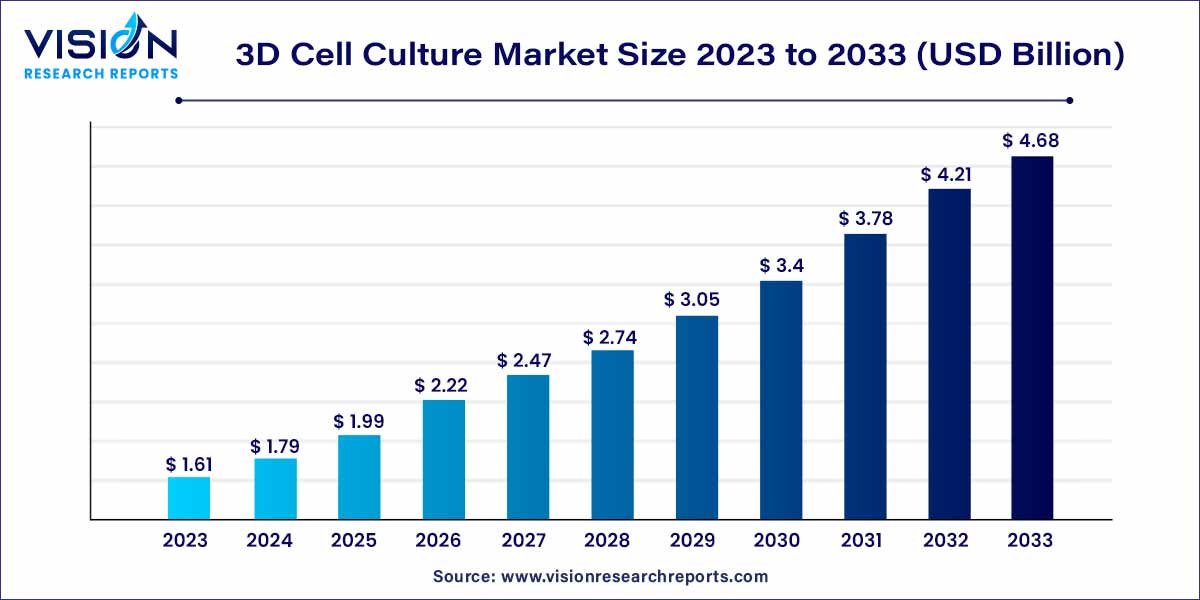

The global 3D cell culture market size was estimated at around USD 1.61 billion in 2023 and it is projected to hit around USD 4.68 billion by 2033, growing at a CAGR of 11.26% from 2024 to 2033. The availability of research funding programs and greater efforts to develop practical alternatives to animal testing are projected to drive growth in the business.

Key Pointers

- In 2023, North America held the biggest market share of 39%, dominating the industry.

- The market is expected to develop at the quickest rate in the Asia Pacific region between 2024 and 2033.

- In 2023, the scaffold-based category had the most revenue share (49%), according to technology.

- The scaffold-free segment is expected to grow at the fastest rate between 2024 and 2033 in terms of technology.

- In terms of application, tissue engineering and stem cell research had the biggest market share in 2023.

- In 2023, the segment comprising pharmaceutical and biopharmaceutical businesses achieved the highest market share based on End Use.

- The academic and research institutions end-use category is expected to grow at the quickest rate over the projection period.

3D Cell Culture Market Overview

A paradigm change in cell culture techniques has been brought about by the notable expansion of the 3D cell culture sector in recent years. Unlike conventional 2D cell culture, this novel method involves growing cells in a three-dimensional environment that closely resembles in vivo settings. This development has attracted significant interest from a variety of scientific fields and industries.

3D Cell Culture Market Growth

The 3D cell culture industry is expanding due to a number of important factors. First, the improved biological relevance provided by 3D techniques is what is driving the transition from conventional 2D cell cultures to the latter. A more realistic depiction of in vivo environments helps researchers produce conclusions that are more representative of real-world situations. Second, 3D cell culture applications are in high demand in the pharmaceutical business, especially for drug research and discovery. One significant benefit of using 3D cultures in screening procedures is their capacity to replicate cellular reactions to possible medications. Furthermore, the expansion of the cancer research market has been greatly aided by the critical function that 3D cell culture models play in comprehending tumor behavior, treatment responses, and personalized therapy.

Get a Sample: https://www.visionresearchreports.com/report/sample/41145

3D Cell Culture Market Dynamics

3D Cell Culture Market Drivers

- Biological Relevance: The adoption of 3D cell culture is driven by its ability to provide a more physiologically relevant environment, enhancing the biological accuracy of cellular responses compared to traditional 2D cultures.

- Pharmaceutical Demand: Growing demand within the pharmaceutical industry is a major driver, with 3D cell culture proving instrumental in drug screening and development, offering a more realistic representation of cellular behavior.

3D Cell Culture Market Restraints

- Technical Expertise Requirement: Effectively utilizing 3D cell culture methodologies often requires a higher level of technical expertise compared to 2D cell cultures. This skill barrier may limit the adoption of 3D cell culture techniques in certain research settings.

- Limited Scalability: Scaling up 3D cell culture systems for large-scale applications, such as industrial production or high-throughput screening, can be challenging. The limited scalability of certain 3D culture methods may restrict their widespread use in certain industries.

3D Cell Culture Market Opportunities

- Advancements in Personalized Medicine: The rise of 3D cell culture provides a unique opportunity for advancements in personalized medicine. The ability to create more realistic cellular environments allows for tailored drug testing, fostering the development of personalized treatment strategies.

- Disease Modeling: 3D cell culture offers an excellent platform for disease modeling, enabling researchers to mimic complex disease states more accurately. This provides opportunities for a deeper understanding of diseases and the development of targeted therapeutics.

Technology Insights

With a 49% market share, the scaffold-based category led the market in 2023. Hydrogels, polymeric scaffolds, micropatterned surfaced microplates, and nanofiber-based scaffolds are further subdivided into this sector. The growing use of scaffold-based cultures in tissue engineering and regenerative medicine, improvements in scaffold materials and fabrication methods, and more funding and cooperation for research are anticipated to be key factors driving the segment’s expansion. By using hydrogels as a framework, researchers can incorporate mechanical and pharmacological cues to replicate the extracellular matrix found in native cells in 3D cell culture models.

The scaffold-free segment, on the other hand, is anticipated to grow at the fastest rate throughout the course of the projection. Improved cellular interactions, more throughput and scalability, growing need for customized therapy, and developments in 3D culture model platforms and technologies are some of the reasons for this segment’s increasing growth. The segment is growing due in part to the strong demand for scaffold-free systems from end-user sectors such research institutes and the biopharmaceutical industry.

Application Insights

The market is categorized based on applications into cancer research, stem cell research & tissue engineering, drug development & toxicity testing, and others. In 2023, the stem cell research & tissue engineering segment held the leading market share. The dominance of this segment can be attributed to the growing demand for biopharmaceuticals, particularly due to the effectiveness of treatments like cell and gene therapy. Increased approvals resulting from a surge in innovation also contribute significantly to the growth of this segment.

Forecasts suggest that, based on current clinical success rates and the product pipeline, the U.S. FDA is expected to approve approximately 10 to 20 cell and gene therapy products annually by 2025. This positive outlook is complemented by technological advancements, supportive government legislation, and augmented funding for stem cell studies. For instance, in March 2023, the National Institute of Health granted Purdue University’s research team USD 2.5 million for stem cell research, aiming to explore novel therapeutic approaches utilizing stem cells, particularly for life-threatening disorders.

In contrast, the cancer research segment is anticipated to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. The increasing prevalence of cancer and the benefits offered by 3D culture models in cancer research are pivotal factors driving the expansion of this segment. Additionally, the advantages of 3D media in modulating cell proliferation and morphology, capturing phenotypic heterogeneity, and providing flexibility further contribute to the overall growth of this segment.

End-use Insights

The market is segmented based on end-use into biotechnology & pharmaceutical companies, academic & research institutes, hospitals, and others. In 2023, the biopharmaceutical & pharmaceutical companies segment held the largest market share. The dominance of this segment is attributed to the ongoing growth and commercial success of biopharmaceuticals, coupled with the strategic utilization of major pharmaceutical companies’ portfolios. The 3D cell culture model provides advantages such as optimal oxygen and nutrient gradient formation, as well as realistic cellular interactions compared to traditional two-dimensional cellular media, making it a preferred method for drug discovery and development. These factors contribute to the increased adoption of 3D cell culture methodologies in the biopharmaceutical and pharmaceutical sectors, driving demand within this segment.

On the other hand, the academic & research institutes segment is poised to register the fastest CAGR during the forecast period. This anticipated growth is fueled by factors such as advancements in biomedical research, a surge in research activities, increasing collaboration between industry and academia, and substantial efforts from research institutions in drug modeling and drug screening. These dynamics collectively contribute to the accelerated expansion of the academic and research institutes segment in the 3D cell culture market.

Regional Insights

In 2023, North America emerged as the dominant force in the market, commanding a substantial 39% share. The region’s market leadership is propelled by advanced healthcare infrastructure, well-established economies, the presence of key industry players, and strategic initiatives undertaken by them. Additionally, a supportive regulatory framework, governmental backing for the development of three-dimensional culture models, and a significant number of research organizations and universities engaged in various stem-cell-based approaches contribute to the robust performance of the regional market. Notably, in April 2023, the American Cancer Society (ACS) announced funding exceeding USD 45 million for 90 innovative Extramural Discovery Science (EDS) research projects at 67 institutes across the United States.

Meanwhile, the Asia Pacific region is poised for the fastest growth in the market from 2024 to 2033. Factors such as a high burden of chronic diseases, a thriving biotechnology sector, cost-effective operations, and increased investments by companies in the region propel the regional market forward. Furthermore, a growing demand for cellular therapies, the establishment of biobanks, and substantial research potential further contribute to the dynamic growth of the Asia Pacific market.

Read More: https://www.heathcareinsights.com/meditation-management-apps-market/

3D Cell Culture Market Key Companies

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- PromoCell GmbH

- Lonza

- Corning Incorporated

- Avantor, Inc.

- Tecan Trading AG

- REPROCELL Inc.

- CN Bio Innovations Ltd

- Lena Biosciences

3D Cell Culture Market Segmentations:

By Technology

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Base Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA Coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

By Application

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

By End Use

- Biotechnology and Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41145

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308