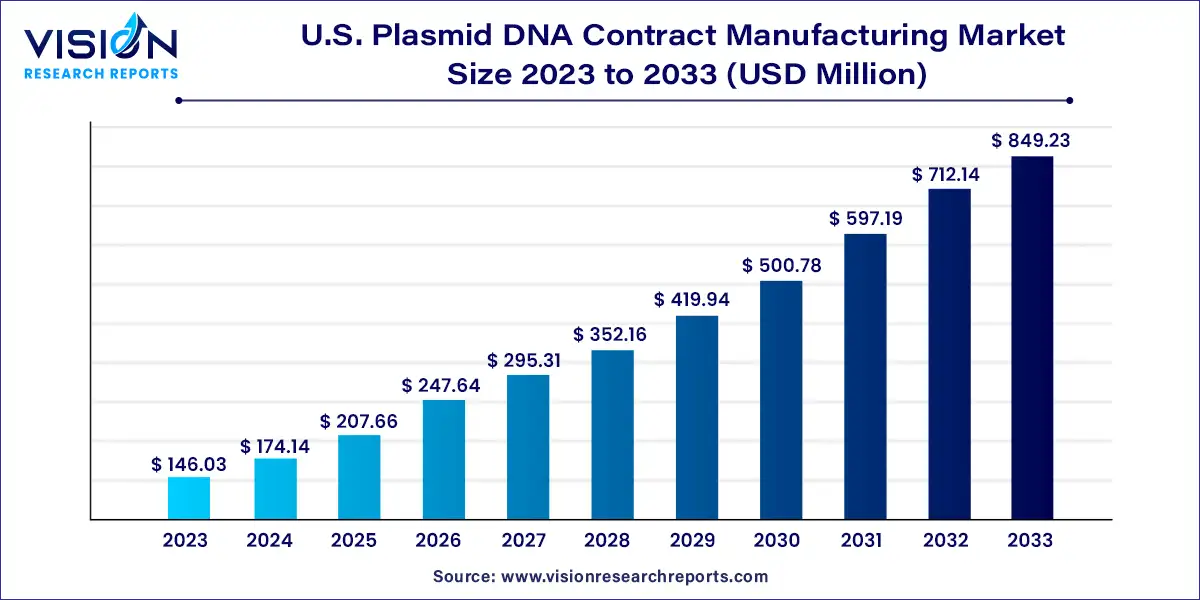

The U.S. plasmid DNA contract manufacturing market size was estimated at USD 146.03 million in 2023 and it is expected to surpass around USD 849.23 million by 2033, poised to grow at a CAGR of 19.25% from 2024 to 2033.

U.S. Plasmid DNA Contract Manufacturing Market Overview

U.S. Plasmid DNA Contract Manufacturing Market Growth

The growth of the plasmid DNA contract manufacturing market in the United States can be attributed to several key factors. Firstly, there is a notable increase in demand for plasmid DNA within the biopharmaceutical industry, particularly for the production of therapeutic proteins and vaccines. This surge in demand is a significant driving force. Additionally, the expanding applications of gene therapies and personalized medicine contribute to the growing need for plasmid DNA manufacturing services.

Moreover, advancements in genetic engineering technologies and the emergence of innovative therapeutic modalities are playing a crucial role in propelling market growth. Collaborations between pharmaceutical companies and contract manufacturers are fostering the market by enabling cost-effective and efficient production processes. Furthermore, the continuous growth in research and development activities in the biotechnology sector is amplifying the demand for outsourced plasmid DNA manufacturing services, thereby sustaining the expansion of the market.

Get a Sample: https://www.visionresearchreports.com/report/sample/41215

U.S. Plasmid DNA Contract Manufacturing Market Trends:

- Rising Demand for Gene Therapies: The market is witnessing a surge in demand driven by the increasing prominence of gene therapies. Plasmid DNA serves as a crucial component in the development of these innovative therapeutic approaches, propelling the contract manufacturing sector.

- Advancements in Genetic Engineering Technologies: Continuous advancements in genetic engineering technologies contribute to the market’s growth. The adoption of cutting-edge techniques enhances the efficiency and scalability of plasmid DNA manufacturing processes, meeting the evolving needs of the biopharmaceutical industry.

- Expanding Applications in Biopharmaceuticals: Plasmid DNA finds extensive applications in the production of therapeutic proteins and vaccines within the biopharmaceutical sector. This diversification of applications increases the market’s significance, with contract manufacturing services playing a pivotal role in meeting the industry’s production demands.

- Increasing Embrace of Personalized Medicine: The trend towards personalized medicine amplifies the demand for plasmid DNA, as it is integral to the development of tailored therapeutic solutions. Contract manufacturers play a key role in facilitating the production of personalized treatments, contributing to market expansion.

Application Insights

Therapeutic insights

In 2023, the cancer segment emerged as the predominant force in the market, securing a substantial 40% share. This growth is primarily driven by the rising prevalence of cancer and the heightened focus of key industry players on cancer therapeutics. The increased adoption of cell and gene therapy for cancer treatment is a key factor propelling the expansion of the U.S. plasmid DNA contract manufacturing market. An illustrative example is the collaboration between Charles River and Rznomics, announced in October 2023, to manufacture viral vectors for gene therapy targeting patients with liver cancer.

Expected to demonstrate the fastest growth rate from 2024 to 2033, the infectious segment is propelled by the growing commercialization of plasmid DNA therapeutics for treating infectious diseases. For instance, the collaboration between GeneScript ProBio and RVAC in February 2023 aimed to manufacture a COVID-19 Vaccine plasmid DNA. This partnership seeks to expedite the clinical manufacturing of RVM-V001 and future mRNA-based vaccines addressing infectious diseases such as Clostridioides difficile infection (CDI) and Respiratory Syncytial Virus (RSV).

End-use Insights

In 2023, pharmaceutical and biotechnology companies held a commanding share of 60%, asserting their dominance in the market. This growth is attributed to the increasing production of plasmid DNA-based therapeutics across the United States. Key market players are actively involved in strategic initiatives to enhance plasmid DNA production, making significant contributions to the expansion of this segment. An illustrative example is Charles River Laboratories International, Inc., which, in January 2023, announced the launch of the eXpDNA™ plasmid platform. This innovative platform aims to streamline plasmid manufacturing and production timelines, particularly in the context of gene therapy.

The research institutes segment is poised for the fastest growth from 2024 to 2033, driven by increasing funding for cell and gene therapy-based research. Research institutes play a crucial role in advancing the research and development of cell and gene therapies, responding to the growing demand for plasmid DNA. The combination of augmented funding and the rising demand for plasmid DNA-based therapeutics is set to propel robust growth in this segment within the plasmid DNA contract manufacturing market. As an example, in September 2019, the National Institutes of Health (NIH) disclosed the allocation of 24 grants to researchers across the United States through the Somatic Cell Genome Editing (SCGE) Program. Funded by the NIH Common Fund, this program aims to enhance genome-editing techniques and the manufacturing of genome-editing therapies.

Read More: https://www.heathcareinsights.com/thermometer-market/

U.S. Plasmid DNA Contract Manufacturing Market Key Companies

- Aldevron

- Charles River Laboratories

- Akron Biotech

- VGXI, Inc.

- Catalent, Inc

- DH Life Sciences, LLC

- Recipharm AB

- TriLink BioTechnologies

- AGC Biologics

- Thermo Fisher Scientific Inc.

Recent Developments

- In February 2023, PackGene Biotech announced the expansion of its services with the addition of a new GMP biomanufacturing and processing facility in Houston, Texas. This consists of gene therapy programs and provides economical, reliable, and scalable AAV products. Through this expansion, the company aims to become a one-stop-shop solution provider for gene therapy developers.

- In January 2023, Catalent announced the new EMA and US FDA-approved pDNA manufacturing facility in Belgium. Through this, Catalent launched a new range of cataloged plasmids to offer support to cell and gene therapy developers

U.S. Plasmid DNA Contract Manufacturing Market Segmentations:

By Application

- Cell & gene therapy

- Immunotherapy

- Other application

By Therapeutic Area

- Cancer

- Infectious Diseases

- Autoimmune Diseases

- Cardiovascular Diseases

- Others

By End-use

- Pharmaceutical and Biotechnology Companies

- Research Institutes

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41215

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308