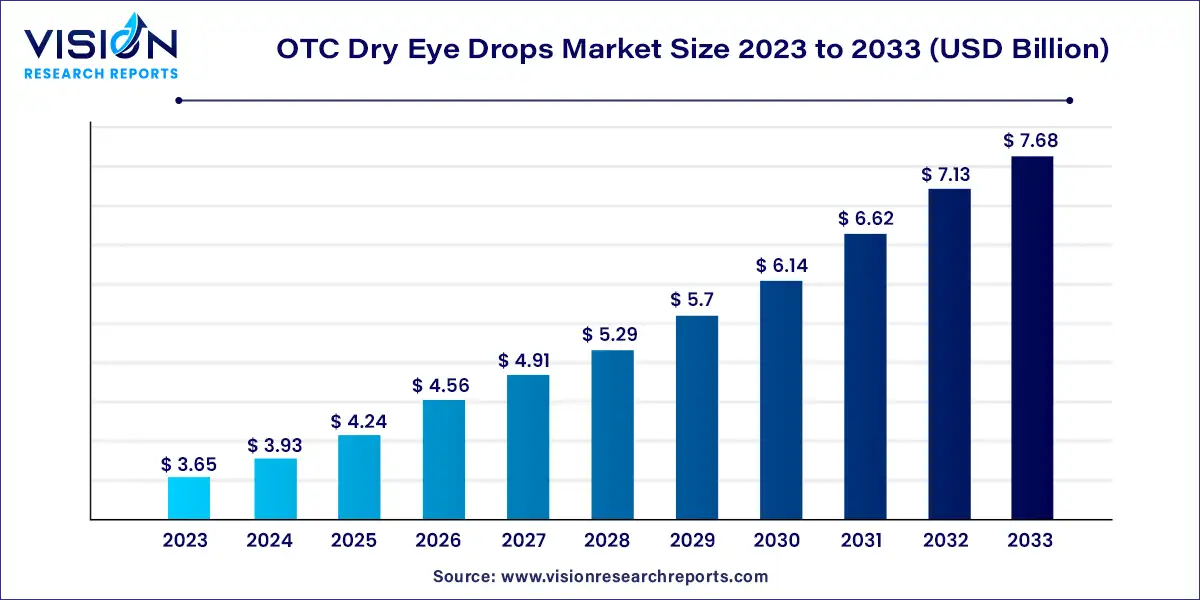

The global OTC dry eye drops market size was estimated at around USD 3.65 billion in 2023 and it is projected to hit around USD 7.68 billion by 2033, growing at a CAGR of 7.72% from 2024 to 2033.

OTC Dry Eye Drops Market Overview

OTC Dry Eye Drops Market Growth

OTC Dry Eye Drops Market Trends

Type Insights

The generics segment held the largest revenue share of 57% in 2023, dominating the market. This dominance is largely attributed to the cost-effectiveness of generic products. Generic options are typically more affordable compared to brand-name alternatives, making them a preferred choice in price-sensitive markets where consumers seek cost-effective solutions to manage their conditions. Moreover, the convenience of purchasing generic products without a prescription further drives segment growth, as they are readily accessible to consumers.

On the other hand, the branded segment is expected to exhibit a promising compound annual growth rate (CAGR) in the coming years. Branded products benefit from established reputation and recognition in the market, instilling a higher level of trust among consumers. Consumers often opt for products from well-known and reputable brands due to their track record of quality and effectiveness. Additionally, branded products often feature unique formulations and delivery methods protected by patents, providing exclusivity in the market. This exclusivity can give branded products a competitive advantage until generics are able to replicate or enhance upon the patented features, thus contributing to overall market growth.

Product Type Insights

The preservative segment took the lead in the market, capturing the largest revenue share of 62% in 2023. Dry eye drops containing preservatives typically boast a longer shelf life compared to their preservative-free counterparts. This extended shelf life appeals to both manufacturers and consumers, as it minimizes the risk of product expiration and waste. Additionally, preservatives serve to inhibit bacterial growth in the solution, allowing the product to be stored at room temperature. This storage convenience enhances the appeal of preservative-containing products to consumers, thereby contributing to overall market growth.

Conversely, the preservative-free segment is poised to experience the highest compound annual growth rate (CAGR) of 8.87% during the forecast period. Preservative-free eye drops are formulated without chemical preservatives, offering a significant advantage for individuals sensitive or allergic to preservatives. Moreover, there’s a growing awareness regarding the potential drawbacks of using preservatives in eye drops, such as dryness, discomfort, and allergic reactions. As a result, consumers are increasingly mindful of the ingredients in the products they use and are actively seeking preservative-free alternatives.

Viscosity Insights

The low-viscosity segment emerged as the market leader, commanding the largest revenue share of 76% in 2023. The primary drivers of segment growth are ease of application and rapid relief. Low-viscosity eye drops are favored for their thin and watery consistency, making them easier to apply and more comfortable to wear. This is especially beneficial for individuals who may struggle with thicker or more viscous formulations. Moreover, these eye drops spread quickly across the ocular surface, providing swift relief to dry and irritated eyes. Additionally, their low viscosity makes them more tolerable and user-friendly compared to gel drops or ointments.

Conversely, the high-viscosity segment is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period in the OTC dry eye drops market. High-viscosity eye drops offer a longer duration of effect compared to their low-viscosity counterparts, which contributes significantly to overall growth. Furthermore, these eye drops can reduce friction, thereby mitigating inflammation, and minimize vision blurring, ultimately enhancing ocular comfort.

Regional Insights

North America asserted its dominance in the market, securing the largest revenue share of 41% in 2023. This was attributed to several factors including its sizable consumer base, advanced healthcare infrastructure, extensive awareness and education regarding health products, and a growing aging population susceptible to dry eye conditions. Additionally, the region benefits from the presence of numerous pharmaceutical companies specializing in OTC products, higher levels of disposable income among consumers, a supportive regulatory environment, and a robust network of retail pharmacies, all contributing to regional growth.

On the other hand, the Asia Pacific region is expected to experience the most rapid growth in the market during the forecast period. This growth is facilitated by the region’s large and expanding population base, an aging demographic leading to increased prevalence of dry eye conditions, and a growing middle class with greater purchasing power. The market in this region is particularly sensitive to pricing and offers promising growth opportunities.

Read More: https://www.heathcareinsights.com/analytical-standards-market/

OTC Dry Eye Drops Market Key Companies

- Rohto Pharmaceutical Co. Ltd.

- AbbVie, Inc.

- Johnson & Johnson Services Inc.

- Santen Pharmaceutical Co. Ltd.

- Novartis AG

- Prestige Consumer Healthcare Inc.

- Altaire Pharmaceuticals Inc.

- Sentiss Pharma Private Limited

- Medicom Healthcare Ltd.

OTC Dry Eye Drops Market Segmentations:

By Type

- Branded

- Generics

By Product Type

- With Preservatives

- Preservatives Free

By Viscosity

- Low Viscosity

- High Viscosity

By Distribution Channel

- Drugstores and Supermarkets

- Online Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/40835

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308