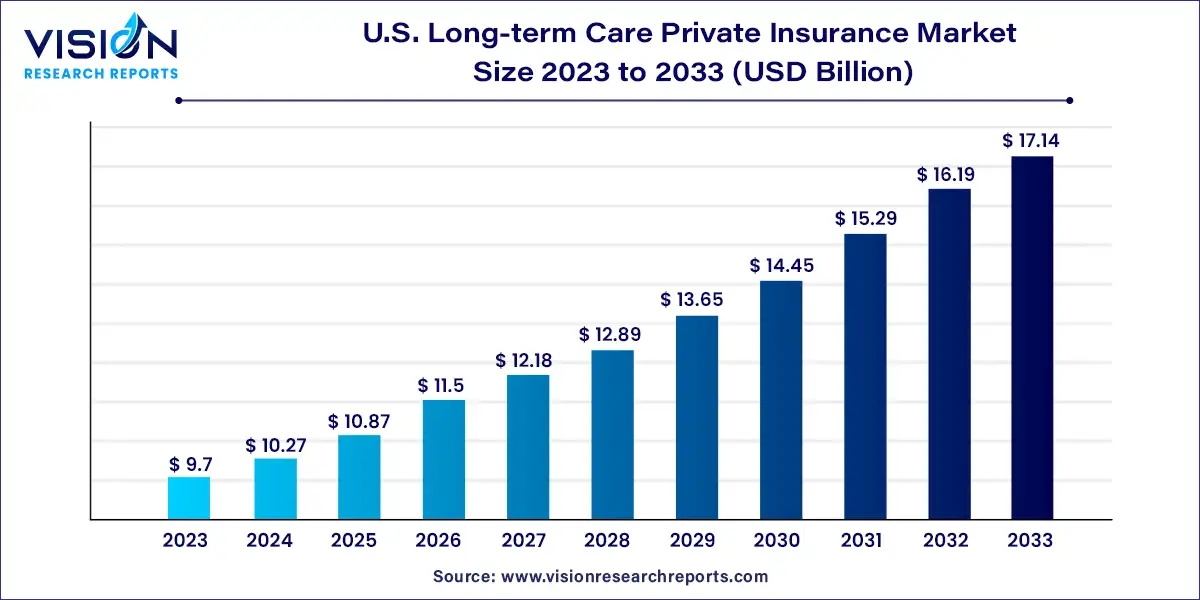

The U.S. long-term care private insurance market was estimated at USD 9.7 billion in 2023 and it is expected to surpass around USD 17.14 billion by 2033, poised to grow at a CAGR of 5.86% from 2024 to 2033.

U.S. Long-term Care Private Insurance Market Overview

U.S. Long-term Care Private Insurance Market Growth Factors

Buyer Age Insights

In 2023, the age group between 55 to 65 accounted for the largest market share, comprising 57% of buyers. Purchasing long-term care insurance within this age bracket offers a lengthier planning horizon. Individuals in this age range have ample time to evaluate their needs, explore insurance options, and make well-informed decisions regarding the coverage that aligns best with their requirements. Additionally, many individuals in this demographic are at the initial stages of retirement planning, leading them to consider potential future needs for long-term care as retirement approaches.

The age group before 55 is also expected to exhibit a notable market share in the forecasted period. This is attributed to the growing awareness surrounding long-term care insurance. There is an increasing emphasis on educating individuals earlier about the costs and risks associated with long-term care, leading to heightened importance placed on this type of coverage. Initiatives in financial planning, awareness campaigns, and shifts in societal attitudes have all played a role in raising awareness about the necessity for early planning and securing long-term care insurance coverage.

Read More: https://www.heathcareinsights.com/biotechnology-market/

U.S. Long-term Care Private Insurance Market Key Companies

- Mutual of Omaha

- New York Life

- Northwestern Mutual

- Thrivent

- National Guardian Life

- Bankers Life

- Transamerica

- MassMutual

- Genworth Financial

- John Hancock

U.S. Long-term Care Private Insurance Market Segmentations:

By Buyer Age

- Before Age 55

- Age 55 to 65

- Age 66+

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/40818

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308