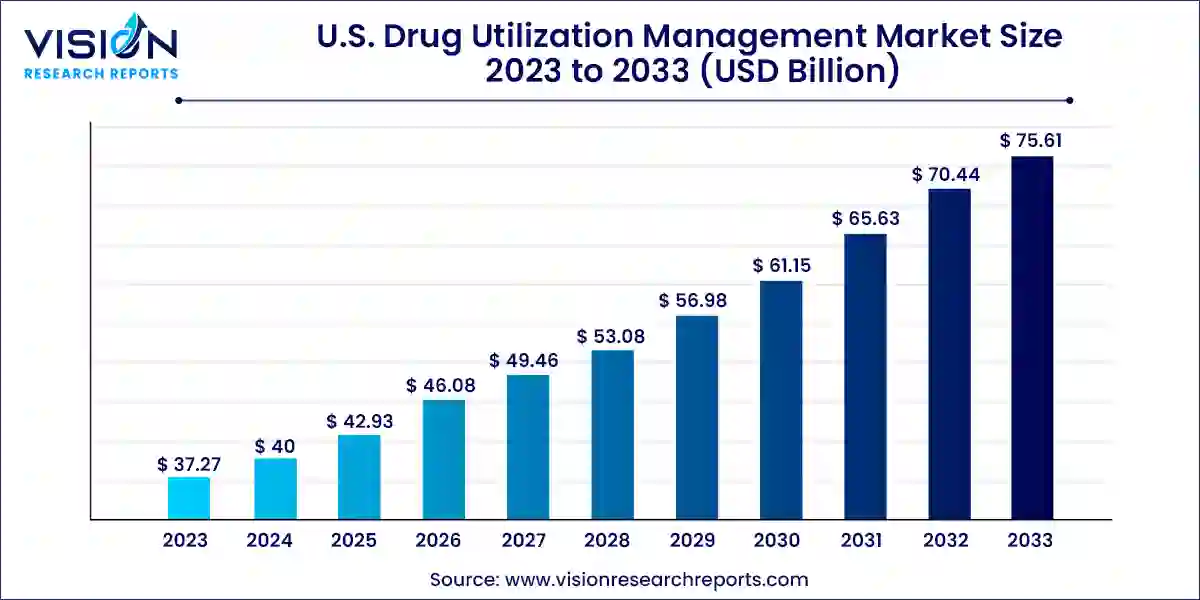

The U.S. drug utilization management market size was valued at USD 37.27 billion in 2023 and it is predicted to surpass around USD 75.61 billion by 2033 with a CAGR of 7.33% from 2024 to 2033.

Introduction to Drug Utilization Management (DUM)

Drug Utilization Management encompasses strategies and programs aimed at optimizing medication therapy and improving patient outcomes. It involves various processes to monitor, evaluate, and manage the use of drugs within healthcare settings. Effective DUM not only enhances patient safety but also contributes to cost containment efforts in the healthcare industry.

Key Pointers

- By Program Type, the in-house segment held the largest revenue share of 66% in 2023.

- By Program Type, the outsourced segment is anticipated to experience rapid growth throughout the forecast period.

- By End-use, the PBMs segment generated the maximum market share of 38% and is projected to exhibit the highest growth rate from 2024 to 2033.

- By End-use, the health plan provider/payors segment is expected to witness significant growth in the forecast period.

Get a Sample@ https://www.visionresearchreports.com/report/sample/41416

Key Components of Drug Utilization Management

Utilization Review (UR)

Utilization Review involves assessing the appropriateness, necessity, and efficiency of medical services and treatments, including drug therapies. It helps in identifying potential overuse, underuse, or misuse of medications.

Formulary Management

Formulary Management focuses on developing and maintaining a list of approved medications covered by healthcare plans. It ensures that prescribed drugs are clinically appropriate and cost-effective.

Medication Therapy Management (MTM)

MTM programs aim to optimize therapeutic outcomes for patients through personalized medication reviews and interventions. They are particularly beneficial for patients with chronic conditions requiring multiple medications.

Regulatory Landscape of DUM in the U.S.

The U.S. DUM market is governed by stringent regulations enforced by the Food and Drug Administration (FDA) and guidelines set by the Centers for Medicare & Medicaid Services (CMS). These regulations ensure that DUM practices comply with safety standards and promote evidence-based medicine.

Technological Innovations in DUM

Advancements in technology, such as Artificial Intelligence (AI) and Machine Learning, are revolutionizing DUM practices. AI-driven algorithms can analyze vast amounts of healthcare data to optimize treatment decisions and predict patient outcomes. Integration with Electronic Health Records (EHR) enhances care coordination and medication management.

Market Trends and Insights

The DUM market in the U.S. is witnessing significant growth driven by increasing healthcare costs and the need for efficient utilization of resources. However, challenges such as regulatory complexities and resistance to change among healthcare providers pose hurdles to market expansion.

Impact of Healthcare Policies on DUM

Healthcare policies like the Affordable Care Act (ACA) have influenced DUM by emphasizing value-based care and patient-centered outcomes. Reforms in Medicaid and Medicare aim to improve medication access and affordability for beneficiaries, thereby shaping DUM strategies.

U.S. Drug Utilization Management Market

Drivers

- Rising Healthcare Costs:

- Driver: Increasing healthcare expenditures necessitate efficient management of drug utilization to curb costs without compromising patient care.

- Impact: Encourages adoption of DUM strategies to optimize medication use and improve cost-effectiveness across healthcare settings.

- Focus on Value-Based Care:

- Driver: Shift towards value-based care models prioritizes patient outcomes and quality of care over volume of services.

- Impact: Promotes the integration of DUM programs that enhance medication adherence, patient safety, and overall health outcomes.

- Technological Advancements:

- Driver: Rapid advancements in AI, Machine Learning, and EHR systems enable sophisticated data analytics and personalized medicine.

- Impact: Facilitates proactive DUM approaches by predicting patient needs, identifying trends in drug utilization, and optimizing treatment plans.

Challenges

- Regulatory Complexity:

- Challenge: Stringent regulatory frameworks and varying state-level policies create compliance challenges for DUM implementation.

- Impact: Requires robust systems and processes to ensure adherence to regulations while maintaining operational efficiency and patient safety.

- Resistance to Change:

- Challenge: Healthcare providers may resist adopting new DUM practices due to workflow disruptions or perceived additional workload.

- Impact: Slows down the adoption of innovative DUM technologies and strategies, hindering potential benefits in patient care and cost savings.

- Data Privacy and Security Concerns:

- Challenge: Managing sensitive patient data in compliance with HIPAA regulations poses significant challenges for DUM initiatives.

- Impact: Requires robust cybersecurity measures and patient consent protocols to safeguard health information and maintain trust in DUM practices.

Opportunities

- Expansion of Telehealth Services:

- Opportunity: Increased adoption of telehealth expands access to healthcare services, driving demand for remote monitoring and DUM solutions.

- Impact: Creates opportunities for telemedicine platforms and DUM providers to collaborate in enhancing medication management and patient outcomes.

- Personalized Medicine Trends:

- Opportunity: Growing focus on personalized medicine tailors treatments to individual patient characteristics and genetic profiles.

- Impact: Enables DUM programs to leverage genetic insights and biomarker data for precision prescribing, improving medication efficacy and reducing adverse effects.

- Collaboration Across Stakeholders:

- Opportunity: Collaborative efforts between pharmaceutical companies, insurers, PBMs, and healthcare providers strengthen DUM strategies.

- Impact: Facilitates integrated care approaches, standardized practices, and data sharing initiatives to optimize drug utilization and enhance healthcare delivery.

Read More@ https://www.heathcareinsights.com/primary-cells-market/

U.S. Drug Utilization Management Market Key Companies

Third Party Providers:

- Prime Therapeutics LLC

- MedicusRx

- EmblemHealth

- Optum, Inc.

- Point32Health, Inc.

- AssureCare LLC

- MindRx Group

- Agadia Systems, Inc

- Elevance Health (CarelonRx)

- ExlService Holdings, Inc.

- MRIoA

- S&C Technologies, Inc.

In-House Providers:

- Ultimate Health Plans

- Security Health Plan of Wisconsin, Inc.

- Blue Cross and Blue Shield Association

- Providence

- Simply Healthcare Plans, Inc

- Health Plan of San Mateo (HPSM)

- PerformRx

- Aetna, Inc. (CVS Health Corp.)

Recent Developments

- In March 2024, Capital Rx and Prime Therapeutics, a prominent pharmacy solutions organization, formed a strategic alliance. Under this partnership, Prime Therapeutics gained exclusive access to Capital Rx’s advanced JUDI enterprise health platform. JUDI, a cloud-native platform, integrates all pharmacy benefit management (PBM) operations into a single system.

- In September 2021, Point32Health, the not-for-profit parent company of Tufts Health Plan and Harvard Pilgrim Health Care, entered a multiyear partnership with Optum Rx. This collaboration aimed to offer integrated PBM solutions, enhancing service delivery and pricing for members of Harvard Pilgrim and Tufts Health Plan.

U.S. Drug Utilization Management Market Segmentation:

By Program Type

- In-house

- Outsourced

By End-use

- PBMs

- Health Plan Provider/Payors

- Pharmacies

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41416

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308