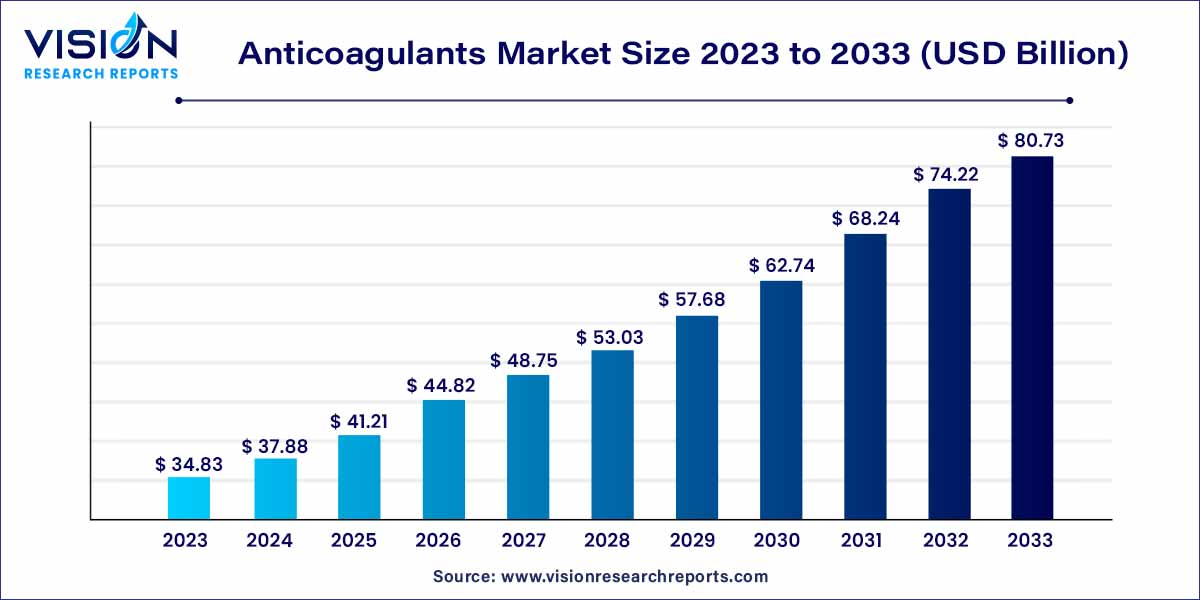

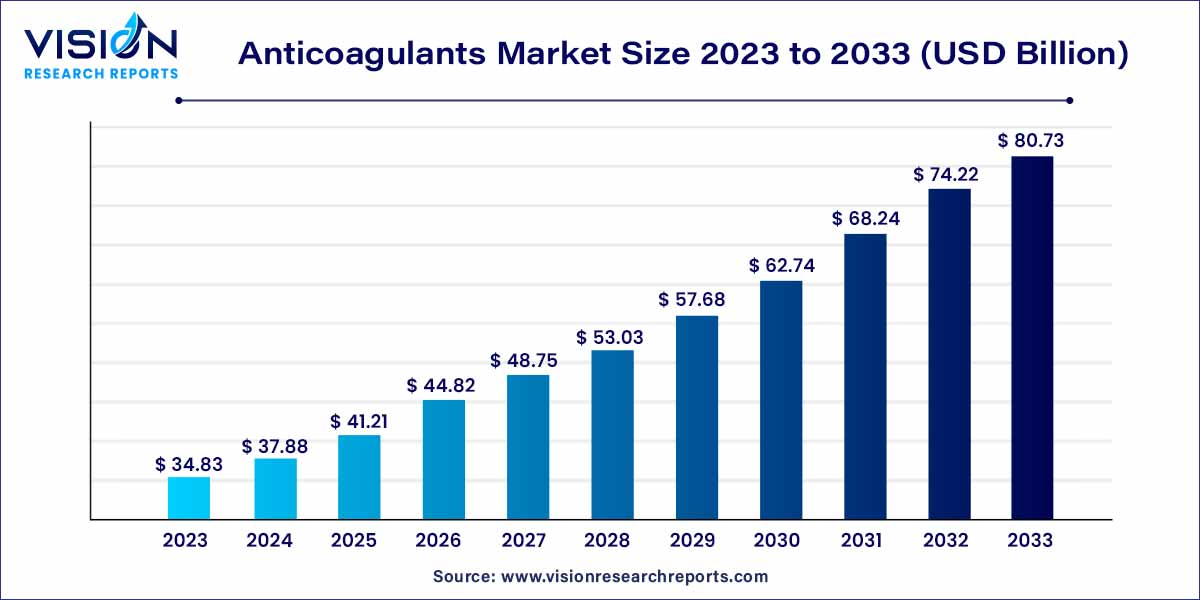

The global anticoagulants market size was estimated at around USD 34.83 billion in 2023 and it is projected to hit around USD 80.73 billion by 2033, growing at a CAGR of 8.77% from 2024 to 2033.

Key Pointers

- In 2023, North America held the highest market share and dominated the industry.

- The market’s fastest CAGR is expected to be achieved by the Asia Pacific region between 2024 and 2033.

- With a 58% revenue share by drug category in 2023, the Novel Oral Anticoagulants (NOACs) segment was the largest.

- The Heparin and Low Molecular Weight Heparin (LMWH) drug category segment is anticipated to grow at the fastest rate between 2024 and 2033.

- In 2023, the oral anticoagulants segment held the highest market share based on Route of Administration.

- During the projected period, the Injectable Anticoagulants category is anticipated to grow at the greatest CAGR by Route of Administration.

- In terms of Application, the market was led by the Atrial Fibrillation/Myocardial Infarction (Heart Attack) segment in 2023.

Anticoagulants Market Overview

The anticoagulants market encompasses the pharmaceutical industry focused on creating, manufacturing, and delivering medications designed to hinder the formation of blood clots. These medications play a crucial role in treating a range of medical conditions, such as cardiovascular diseases, deep vein thrombosis, pulmonary embolism, and stroke. By impeding the clotting process, anticoagulants lower the likelihood of dangerous blood clots that may result in severe health issues.

Anticoagulants Market Growth

The growth of the anticoagulants market is spurred by various key factors. Firstly, the increasing prevalence of cardiovascular diseases and related conditions worldwide plays a significant role. With the global population aging and lifestyles becoming more sedentary, there’s a rising incidence of conditions like atrial fibrillation, deep vein thrombosis, and pulmonary embolism, driving up the demand for anticoagulant medications. Additionally, advancements in medical technology and treatment protocols have enhanced the effectiveness and safety of anticoagulants, leading to greater acceptance and usage among healthcare providers and patients alike. Moreover, the growing awareness about the importance of preventive healthcare measures and early intervention has encouraged the adoption of anticoagulants as a crucial component of managing cardiovascular diseases. Furthermore, supportive government initiatives, favorable reimbursement policies, and increasing healthcare expenditure in both developed and emerging markets contribute to the sustained growth of the anticoagulants market. Overall, these factors collectively drive the market forward, fostering innovation, investment, and expansion in the field of anticoagulant therapies.

Drug Category Insights

In 2023, the Novel Oral Anticoagulants (NOACs) segment dominated the market, accounting for 58% of the revenue share. This leadership position is fueled by the growing adoption of NOACs in developing countries, where they are preferred over warfarin due to their efficacy and safety profile. NOACs offer fixed dosing regimens and predictable pharmacokinetics, simplifying patient management by eliminating the need for frequent monitoring and dose adjustments required with warfarin. This enhances patient compliance and convenience. Additionally, NOACs have fewer drug interactions compared to warfarin, thereby reducing the risk of adverse reactions and complications from concurrent medications.

During the forecast period, the Heparin and Low Molecular Weight Heparin (LMWH) segment is projected to experience the highest Compound Annual Growth Rate (CAGR). This growth is driven by the expanding indications for heparin and LMWH, which now encompass acute treatment and prevention in high-risk patients, such as those undergoing major surgery or experiencing prolonged immobilization. The rising incidence of thrombotic events further contributes to the demand for heparin and LMWH. Moreover, these agents are often perceived as cost-effective anticoagulant options, particularly in healthcare settings with limited resources. Their affordability and effectiveness make them attractive choices across various healthcare systems globally.

Route of Administration Insights

In 2023, the oral anticoagulants segment dominated the market, holding the largest share, and is anticipated to maintain the fastest growth rate throughout the forecast period. This segment has witnessed notable advancements in enhancing patient convenience, compliance, and drug development. Oral anticoagulants offer a user-friendly alternative to traditional injectable forms, particularly advantageous for long-term therapy where patient adherence is crucial. The simplicity of administration significantly contributes to the preference for oral anticoagulants among healthcare providers and patients alike. Several pharmaceutical companies are actively engaged in the development and commercialization of oral anticoagulants, focusing on innovations such as novel formulations and improved safety profiles. For instance, in December 2020, NATCO Pharma Limited introduced the Rivaroxaban molecule under the brand name RPIGAT, an oral anticoagulant medication used for treating blood clots, available in various strengths.

The Injectable Anticoagulants segment is expected to witness substantial growth during the forecast period. This growth is propelled by its increasing utilization in treating various medical conditions including deep vein thrombosis, pulmonary embolism, and atrial fibrillation. Injectable anticoagulants, administered through injections, offer a faster onset of action compared to oral alternatives. Additionally, the global prevalence of chronic conditions such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism is on the rise, necessitating anticoagulant therapy to prevent blood clots and associated serious complications like stroke and heart attack. These factors are anticipated to bolster the injectable anticoagulants segment in the forthcoming years.

Application Insights

The Atrial Fibrillation/Myocardial Infarction (Heart Attack) segment held the largest share of the market. Atrial fibrillation, a common heart condition that can lead to blood clots and stroke, has made anticoagulants a highly effective treatment option for reducing the risk of these complications. With the increasing prevalence of atrial fibrillation, there’s a growing demand for anticoagulants, making the atrial fibrillation application segment a significant driver of market growth. According to CDC estimates, approximately 12.1 million individuals in the US are expected to suffer from atrial fibrillation by 2030. Additionally, factors such as increasing healthcare expenditure and growing awareness about the benefits of anticoagulants have also contributed to this growth.

The Deep Vein Thrombosis (DVT) segment is forecasted to experience the fastest growth rate during the forecast period. The prevalence of DVT is increasing globally due to factors such as an aging population, sedentary lifestyles, and rising obesity rates. For instance, according to the CDC, approximately 900,000 people are affected by DVT annually in the US. Anticoagulants’ usage is expanding in acute treatment in DVT management to include long-term prophylaxis for patients at high risk of recurrent DVT. This expanded application is propelling the growth of this segment.

Regional Insights

In 2023, North America secured the largest revenue share in the market. The region’s market expansion is credited to the robust demand for innovative products and the escalating prevalence of cardiovascular disorders. According to the CDC, heart diseases caused the deaths of approximately 659,000 individuals annually in February 2022, accounting for nearly 25% of all U.S. deaths. This upsurge in cardiovascular diseases has triggered a heightened demand for anticoagulants. Furthermore, the presence of leading pharmaceutical and biotechnology companies engaged in therapeutic development, along with a well-established healthcare infrastructure, is propelling the growth of the regional market.

The Asia Pacific region is poised to achieve the fastest compound annual growth rate (CAGR) in the market. This growth is propelled by the increasing prevalence of chronic diseases, a burgeoning geriatric population, and rising healthcare expenditure in the region. Additionally, factors such as growing awareness about the benefits of early diagnosis and treatment of blood clots, escalating investments in the healthcare sector, and advancements in technology are contributing to market expansion in this region.

Anticoagulants Market Key Companies

- Aspen Holdings

- Pfizer Inc.

- Bristol-Myers Squibb Company

- GSK plc

- Sanofi

- Bayer AG

- Boehringer Ingelheim International GmbH

- DAIICHI SANKYO COMPANY, LIMITED

- Johnson & Johnson Services, Inc.

- Eisai Co., Ltd.

Anticoagulants Market Segmentations:

By Drug Category

- Novel Oral Anticoagulants (NOACs)

- Eliquis

- Xarelto

- Savaysa & Lixiana

- Pradaxa

- Vitamin K Antagonist

- Direct Thrombin Inhibitors

- Heparin and Low Molecular Weight Heparin (LMWH)

- Others

By Route of Administration

- Oral Anticoagulants

- Injectable Anticoagulants

By Application

- Atrial Fibrillation/Myocardial Infarction (Heart Attack)

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308

Blog: https://www.novaoneadvisor.com/

Web: https://www.visionresearchreports.com/