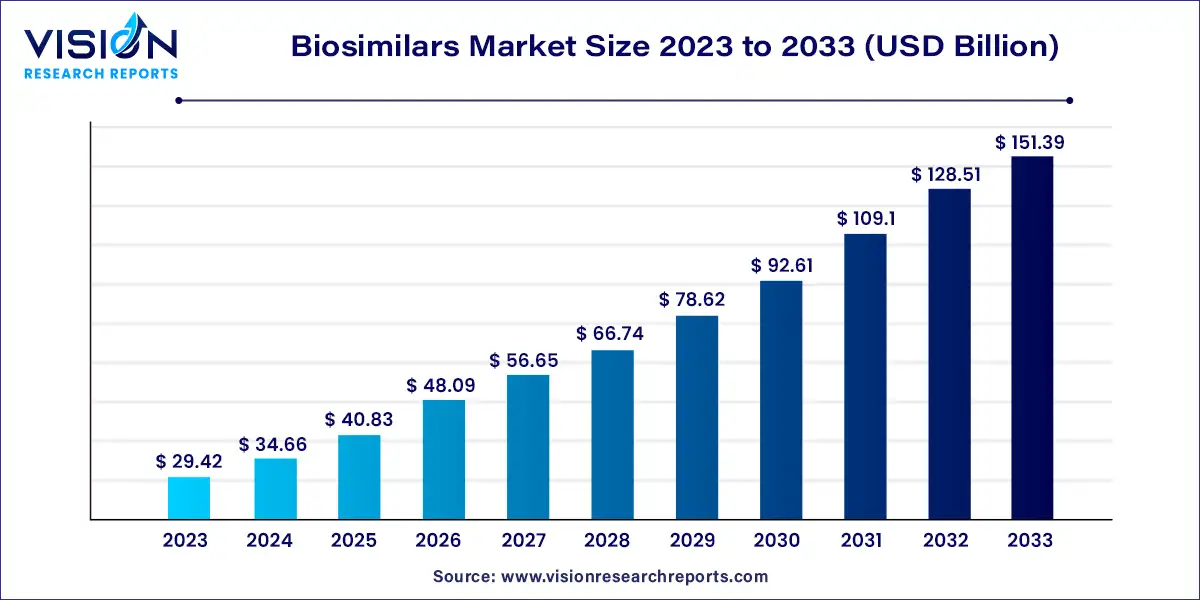

The biosimilars market size is projected to touch USD 151.39 billion by 2033 from USD 29.42 billion in 2023, growing at a CAGR of 17.8% during the forecast period 2024 to 2033.

Biosimilars Market Highlights:

Future Trends in the Biosimilars Market

1. Continued Growth and Expansion:

- Patent Expirations: The pipeline of biosimilars is robust, with numerous products awaiting approval. As more patents expire for high-selling biologics, the market is expected to expand significantly.

- Emerging Markets: Developing countries with growing healthcare needs are becoming attractive markets for biosimilars, offering opportunities for manufacturers and patients alike.

2. Advancements in Manufacturing Technology:

- Biotechnology Innovations: Continuous advancements in biotechnology are enabling more efficient and cost-effective production of biosimilars.

- Single-Use Technologies: The adoption of single-use technologies is reducing the risk of contamination and improving manufacturing flexibility.

3. Increasing Complexity of Biosimilars:

- Complex Biologics: As the focus shifts towards more complex biologics, such as monoclonal antibodies and fusion proteins, the development and approval processes for biosimilars will become more challenging.

- Biosimilar Combinations: There is growing interest in developing biosimilar combinations to address complex diseases and improve patient outcomes.

4. Regulatory Landscape and Global Harmonization:

- Regulatory Clarity: Efforts are underway to establish clear regulatory frameworks and guidelines for biosimilars, ensuring consistency and facilitating global market access.

- Global Harmonization: International collaboration is crucial to harmonize regulatory requirements and promote the global trade of biosimilars.

5. Focus on Patient Access and Affordability:

- Healthcare Cost Reduction: Biosimilars offer a potential solution to rising healthcare costs by providing affordable alternatives to branded biologics.

- Patient Education: Raising awareness about biosimilars and their benefits is essential for increasing patient acceptance and improving access to these products.

Ask here for more customization study@ https://www.visionresearchreports.com/report/customization/41588

Biosimilars Market by Regional Outlook

In 2023, Europe led the global market with a dominant share of 34% and is projected to maintain this leadership throughout the forecast period. This strong position is largely due to the widespread adoption of biosimilars across the region and the proactive stance of European regulatory authorities. Favorable regulatory changes have streamlined the approval process for biosimilar drugs, further boosting market expansion.

North America is also anticipated to see significant growth in the coming years. This is driven by increasing acceptance of biosimilars and substantial investments in research and development by various market players. In 2020, the FDA approved approximately 20 biosimilars, including Pfizer’s Nyvepria, which is aimed at reducing infection rates. These advancements are expected to propel the biosimilars market in North America.

Biosimilars Market Product Outlook

In 2023, monoclonal antibodies held the largest revenue share. These antibodies are extensively used for treating a range of conditions, including cancer, rheumatoid arthritis, cardiovascular diseases, and multiple sclerosis. Their precision in targeting specific infected cells makes them particularly effective for cancer treatment, establishing them as the leading segment in the market.

The erythropoietin segment is forecasted to grow the fastest during the forecast period. Erythropoietin plays a crucial role in stimulating red blood cell production in the bone marrow and is used to treat anemia. The rising prevalence of kidney-related diseases is expected to drive this segment’s rapid growth.

Biosimilars Market Application Outlook

In 2023, the oncology segment was the top revenue generator in the global biosimilars market and is expected to maintain its leading position throughout the forecast period. This is attributed to the cost-effectiveness of biosimilars for cancer treatment and the increasing global cancer incidence. The International Agency for Research on Cancer reported about 19.3 million new cancer cases and 10 million cancer-related deaths worldwide in 2020. The high prevalence of breast cancer (11.7% of new cases), followed by lung cancer (11.4%) and colorectal cancer (10.0%), highlights the growing demand for biosimilars in oncology.

Conversely, the segment for growth hormone deficiencies is projected to expand the fastest. The rising incidence of growth hormone deficiencies in children—estimated at a 50% likelihood during pregnancy according to the National Organization for Rare Disorders—is expected to drive significant growth in this segment.

COVID-19 Impact

The COVID-19 pandemic had a multifaceted impact on market growth, driven by both increased focus on healthcare and heightened demand for affordable treatment options. The crisis underscored the importance of robust and diversified supply chains, leading to a push for local production of essential medications, including biosimilars. This shift aimed to enhance the availability and accessibility of these treatments.

However, the pandemic also introduced several challenges. Clinical studies for biosimilars faced delays, and global supply chains experienced significant disruptions, affecting production and distribution. Additionally, the reallocation of healthcare resources towards managing COVID-19 further slowed the progress of the biosimilars market, as attention and resources were diverted from other areas of healthcare.

Biosimilars Market News

- In May 2023, Boehringer Ingelheim secured U.S. FDA approval for the Cyltezo Pen, a new autoinjector for Cyltezo (adalimumab-adbm), an interchangeable biosimilar to Humira. This development marks a significant advancement in the biosimilars market, providing a new delivery option for this widely used biosimilar.

- In June 2022, Biogen Inc. announced a partnership with Samsung Bioepis Co., Ltd. to launch BYOOVIZ (ranibizumab-nuna), a biosimilar to LUCENTIS (ranibizumab) in the U.S. This collaboration highlights the ongoing efforts to expand the availability of biosimilar treatments, aiming to offer more affordable options for patients.

Read More@ Prefilled Syringes Market

Top Manufactures in Biosimilars Market

- Novartis

- Synthon Pharmaceuticals, Inc.

- TevaPharmaceutical Industries Ltd.

- LG Life Sciences

- Celltrion

- Biocon

- Hospira

- Merck Serono

- Biogen idec, Inc.

- Genentech

Biosimilars Market Segmentation:

By Product

- Monoclonal Antibodies

- Somatropin

- Insulin

- Erythropoietin

- Follitropin

- Others

By Application

- Oncology

- Growth Hormonal Deficiency

- Blood Disorders

- Chronic & Autoimmune Disorders

- Infectious Disease

- Others

By Manufacturer

- Contract Research and Manufacturing Services

- In-house

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41588

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308