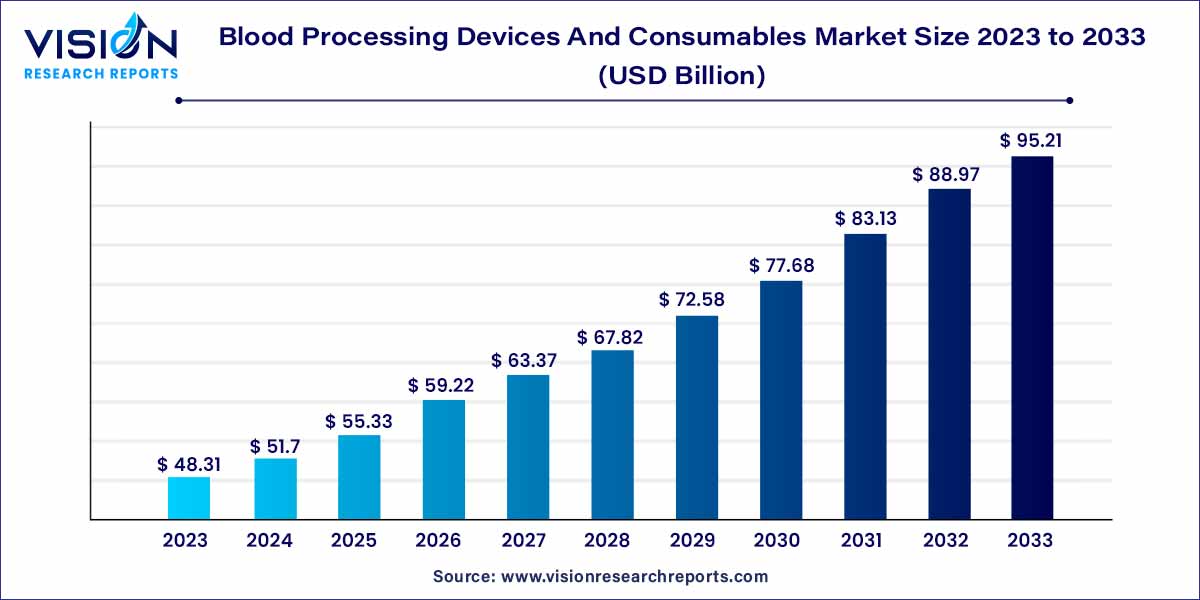

The global blood processing devices and consumables market was estimated at USD 45.32 billion in 2022 and it is expected to surpass around USD 89.65 billion by 2032, poised to grow at a CAGR of 7.06% from 2023 to 2032. The blood processing devices and consumables market in the United States was accounted for USD 15.6 billion in 2022.

Key Pointers

- North America led the market with highest revenue share of 41% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 8.46% during the forecast period.

- By Product, the devices segment captured the maximum market share of 61% in 2022.

- By Product, the consumables segment is anticipated to grow at the fastest CAGR of 7.65% during the forecast period.

- By End Use, the other segment generated the maximum market share of 46% in 2022.

- By End Use, the diagnostic laboratories segment is expected to expand at the highest CAGR of 8.36% over the forecast period.

The blood processing devices and consumables market is a vital sector within the healthcare industry, playing a pivotal role in the safe and efficient management of blood products. This market encompasses a diverse range of devices and consumables designed to collect, process, store, and transfuse blood and its components. Blood processing devices include automated systems for blood separation, centrifuges, and blood bank refrigerators, while consumables comprise collection sets, blood bags, and various reagents used in blood testing.

Market Growth

The growth of the blood processing devices and consumables market is fueled by several key factors. One of the primary drivers is the increasing demand for blood transfusions due to rising surgical procedures, trauma cases, and prevalence of chronic diseases. Technological advancements in blood processing devices, such as automated systems and advanced testing methods, contribute significantly to market growth by enhancing the efficiency and safety of blood processing procedures. Additionally, growing awareness initiatives promoting voluntary blood donations have ensured a steady supply of blood, necessitating the adoption of advanced processing equipment. Furthermore, the prevalence of blood disorders, such as anemia and hemophilia, continues to drive the demand for blood products, further boosting the market. Despite challenges like stringent regulatory compliance and high initial costs, the market’s future outlook remains positive, with collaborative efforts and continuous innovations expected to drive sustained growth.

Get a Sample: https://www.visionresearchreports.com/report/sample/40888

Report Scope of the Blood Processing Devices And Consumables Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 41% |

| CAGR of Asia Pacific from 2023 to 2032 | 8.46% |

| Revenue Forecast by 2032 | USD 89.65 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.06% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Biomerieux SA; Abbott; Bio-Rad Laboratories, Inc.; BD.; F. Hoffmann-La Roche Ltd; Danaher.; Immucor, Inc.; ThermoGenesis Holdings, Inc.; Grifols; S.A.; Terumo Corporation; Haemonetics Corporation; Macopharma |

Read More: https://www.heathcareinsights.com/acne-treatment-market/

Market Dynamics

Drivers

Increasing Demand for Blood Transfusions:

The rising number of surgeries, trauma cases, and chronic diseases has led to a growing demand for blood transfusions, necessitating advanced processing devices and consumables.

Global Increase in Surgical Procedures:

The rise in surgical interventions worldwide, including elective surgeries and emergency procedures, has increased the need for blood transfusions, thereby boosting the market for blood processing devices and consumables.

Restraints

Limited Shelf Life:

Blood and its components have limited shelf lives, typically ranging from a few days to a few weeks. Managing inventory effectively to minimize wastage due to expiration is a constant challenge for blood banks and healthcare institutions, necessitating efficient supply chain management solutions.

Complexity of Blood Processing Procedures:

Blood processing involves intricate procedures, and the complexity of these processes can pose a challenge in terms of staff training and operational efficiency. Ensuring that healthcare professionals are well-trained to handle these advanced devices is crucial for their effective utilization.

Opportunities

Advancements in Blood Processing Technologies:

Ongoing advancements in blood processing technologies, such as miniaturization, automation, and integration of IoT (Internet of Things), provide opportunities for innovation. Companies investing in research and development to create more efficient and cost-effective devices can gain a competitive edge.

Demand for Point-of-Care Testing:

There is a growing trend toward point-of-care testing, especially in remote and resource-limited settings. Blood processing devices that enable rapid and accurate testing at the point of care have significant market potential, addressing the need for timely diagnosis and treatment.

Challenges

Risk of Contamination:

Maintaining strict sterile conditions is vital to prevent contamination of blood and blood products. The risk of contamination during processing, storage, or transportation can compromise the quality and safety of blood products, posing a significant challenge to manufacturers and healthcare providers.

Supply Chain Challenges:

Ensuring a consistent supply of high-quality consumables, such as blood bags and reagents, can be challenging. Supply chain disruptions, quality issues, or delays in procurement can impact the overall efficiency of blood processing operations, posing a challenge to healthcare institutions.

Product Insights

The devices segment accounted for the largest revenue share of 61% in 2022. Blood processing devices comprise a range of sophisticated equipment designed to handle various stages of blood processing, from collection to storage. These devices include automated blood component separation systems, centrifuges, blood bank refrigerators, and blood irradiation equipment. Automated systems are gaining prominence due to their ability to process large volumes of blood quickly and accurately, ensuring the efficient separation of blood components like red blood cells, plasma, and platelets. Centrifuges, on the other hand, are essential for separating blood components by density, while blood bank refrigerators are vital for preserving blood products at specific temperatures to maintain their integrity. Blood irradiation equipment is utilized for pathogen reduction, enhancing the safety of blood transfusions.

- For instance, in 2021, U.S. healthcare spending increased by approximately 2.7%, amounting to USD 4.3 trillion or USD 12,914 per person.

The consumables segment is expected to grow at the fastest CAGR of 7.65% during the forecast period. Blood processing consumables encompass a wide array of supplies required for collecting, testing, and storing blood. These include blood bags, blood collection tubes, needles, anticoagulants, and various reagents used in blood testing procedures. Blood bags, available in different sizes and configurations, serve as the primary containers for collected blood and its components. Blood collection tubes are designed to collect blood samples for diagnostic testing, and needles facilitate safe and efficient blood collection procedures. Anticoagulants are essential additives that prevent blood clotting, ensuring the preservation of blood samples for testing purposes. Reagents, such as enzymes and antibodies, are critical components used in blood typing and screening tests, providing accurate results for compatibility assessments prior to transfusions.

- For instance, in February 2020, a new action plan has been proposed by the World Health Organization (WHO) to fasten the process of access to secure blood and blood products worldwide.

End-use Insights

The other segment captured the maximum market share of 46% in 2022. The category of “Others” in the blood processing devices and consumables market includes a wide array of end users such as research institutions, biotechnology companies, and pharmaceutical firms. These entities utilize blood processing devices and consumables in various research applications, including drug development, clinical trials, and academic research. Blood-related research is crucial for understanding diseases, developing new therapies, and conducting experiments that advance medical knowledge. Therefore, the demand for specialized blood processing devices and high-quality consumables is substantial among these diverse entities. These end users often require customized solutions to meet their specific research needs, leading to a continuous demand for innovative and advanced blood processing products.

- For instance, in March 2021, Grifols, S.A., a renowned global company specializing in plasma-derived therapies and advanced diagnostic solutions, has recently launched the DG Reader Net semi-automated analyzer in North America.

The diagnostic laboratories segment is expected to expand at the highest CAGR of 8.36% over the forecast period. Diagnostic laboratories are a cornerstone of the healthcare industry, providing critical information to healthcare providers for accurate diagnoses and treatment decisions. These laboratories perform a wide range of blood tests, including blood typing, infectious disease screening, and monitoring of various health parameters. Blood processing devices and consumables are indispensable tools for diagnostic laboratories, enabling them to process blood samples efficiently and accurately. Automated systems, centrifuges, blood collection tubes, and reagents are essential components of diagnostic laboratories, ensuring the precision and reliability of test results. With the increasing prevalence of diseases requiring regular monitoring, such as diabetes and cardiovascular conditions, diagnostic laboratories continue to experience a growing demand for blood processing devices and consumables. Additionally, advancements in diagnostic technologies have led to the development of innovative devices that enhance the speed and accuracy of blood tests, further driving the market in this segment.

Regional Insights

North America dominated the market with largest revenue share of 41% in 2022. North America, particularly the United States, stands as a major market for blood processing devices and consumables. The region benefits from robust healthcare infrastructure, extensive research and development activities, and high healthcare expenditure. Stringent regulatory standards ensure the quality and safety of blood processing products, driving innovation within the industry. Additionally, the presence of key market players and the high prevalence of chronic diseases contribute significantly to market growth in this region.

Asia Pacific is anticipated to grow at the fastest CAGR of 8.46% during the forecast period. The Asia-Pacific region is witnessing rapid growth in the Blood Processing Devices and Consumables market. Developing countries like China and India are investing substantially in healthcare infrastructure, leading to increased demand for blood processing devices. The market in this region benefits from a large patient pool, rising prevalence of chronic diseases, and initiatives to improve healthcare accessibility. Moreover, the presence of emerging economies fosters collaborations between local manufacturers and international companies, encouraging market growth.

- For instance, the National Blood Transfusion Council (NBTC) of India was formed to ensure the availability of safe and quality blood and blood products throughout the country.

Blood Processing Devices And Consumables Market Report Segmentations:

By Product

- Devices

- Consumables

By End Use

- Hospitals and Clinics

- Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/40888

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308