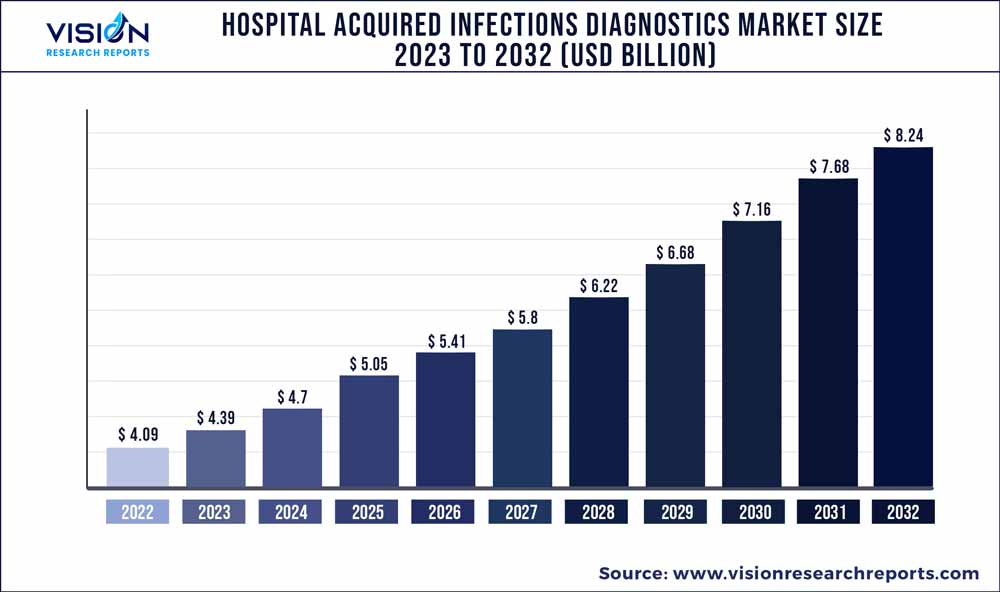

The global hospital acquired infections diagnostics market was surpassed at USD 4.09 billion in 2022 and is expected to hit around USD 8.24 billion by 2032, growing at a CAGR of 7.25% from 2023 to 2032.

Key Pointers

- Europe region led the market with the largest revenue share of 35% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 9.05% from 2023 to 2032.

- By Test Type, the molecular tests segment accounted for the largest revenue share of 51% in 2022 and is expected to expand at the fastest CAGR of 9.43% during the forecast period.

- By Product, the consumables segment held the largest revenue share of 64% in 2022 and is expected to expand at the fastest CAGR of 7.73% over the forecast period.

- By Type, the blood tests segment accounted for the largest revenue share of 66% in 2022 and is expected to advance at the fastest CAGR of 7.09% during the forecast period.

Hospital-acquired infections (HAIs) represent a significant concern in healthcare settings, necessitating a robust and evolving diagnostics market to address these challenges. This overview provides insights into the key components, drivers, and dynamics shaping the Hospital-Acquired Infections Diagnostics Market.

Get a Sample: https://www.visionresearchreports.com/report/sample/40981

Market Growth

The growth of the hospital-acquired infections diagnostics market is propelled by several key factors. Firstly, the escalating prevalence of hospital-acquired infections globally underscores the imperative for advanced diagnostic solutions. As healthcare facilities face an increasing burden of nosocomial infections, the demand for accurate and swift identification tools intensifies. Additionally, continuous technological advancements play a pivotal role in market expansion. Innovations in molecular diagnostics, immunoassays, and rapid testing methods contribute to enhanced diagnostic accuracy and efficiency, catering to the evolving needs of healthcare professionals. The industry’s heightened focus on infection prevention and control measures further drives market growth, with diagnostics serving as a critical component in early detection and intervention. Moreover, global health challenges, exemplified by events like the COVID-19 pandemic, underscore the necessity for agile and adaptable diagnostic solutions, reinforcing the market’s role in safeguarding public health. Compliance with stringent regulatory standards ensures the quality and reliability of diagnostic tools, instilling confidence among healthcare providers and contributing to the overall growth trajectory of the Hospital-Acquired Infections Diagnostics Market.

Report Scope of the Hospital Acquired Infections Diagnostics Market

| Report Coverage | Details |

| Market Revenue by 2032 | USD 8.24 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.25% |

| Revenue Share of Europe in 2022 | 35% |

| CAGR of Asia Pacific from 2023 to 2032 | 9.05% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Market Dynamics

Drivers

- Prevalence of Hospital-Acquired Infections (HAIs): The persistent rise in HAIs globally serves as a primary driver for the Hospital-Acquired Infections Diagnostics Market. The increasing incidence of these infections emphasizes the crucial need for effective diagnostic solutions to identify and manage infections acquired during healthcare facility stays.

- Technological Advancements in Diagnostics: Ongoing advancements in diagnostic technologies, including molecular diagnostics, immunoassays, and rapid testing methods, play a pivotal role in driving market growth. These innovations enhance the accuracy, speed, and efficiency of diagnostic processes, meeting the evolving demands of healthcare professionals.

Restraints

- Data Security and Privacy Concerns: As diagnostic technologies become more sophisticated and interconnected, concerns regarding the security and privacy of patient data emerge as potential restraints. Healthcare providers must address these concerns to ensure the trust and confidence of both patients and regulatory bodies.

- Integration Challenges: The seamless integration of new diagnostic technologies into existing healthcare systems can pose challenges. Compatibility issues with electronic health records and other healthcare information systems may slow down the adoption of advanced diagnostics in some settings.

Opportunities

- Increased Focus on Point-of-Care Testing: The rising demand for rapid and on-site diagnostics creates opportunities for point-of-care testing solutions. Innovations that enable healthcare professionals to swiftly and conveniently perform diagnostic tests at the patient’s bedside contribute to more immediate and targeted interventions.

- Global Collaborations for Research and Development: Collaborative efforts among healthcare organizations, research institutions, and diagnostic companies present opportunities for joint research and development initiatives. Such partnerships can accelerate the discovery and implementation of novel diagnostic solutions, addressing the dynamic nature of hospital-acquired infections.

Test Type Insights

The molecular tests segment accounted for the largest revenue share of 51% in 2022 and is expected to expand at the fastest CAGR of 9.43% during the forecast period. Molecular diagnostic microbiology tests have become widely available due to technological advancements and commercial business incentives. Owing to an urgent need for more sophisticated disease detection systems, this segment is expected to maintain its dominance through 2032.

Using these approaches directly on clinical samples minimizes the time it takes to respond. It also has economic benefits because it takes less time to receive proper medical care, which minimizes hospitalization expenses and the risks of co-morbidity and death. According to an article published by the National Center for Biotechnology Information in October 2018, metagenomic next-generation sequencing (mNGS) is a strong pathogen detection technology that may identify nucleic acids (DNA and RNA) of all infectious illnesses, including bacteria, fungi, viruses, and parasites, in a single test.

Infection Type Insights

HAIs contribute to significant morbidity, mortality, and financial burden on patients, families, and healthcare systems. According to an article by the National Center for Biotechnology Information (NCBI), in October 2018, 3.2% of all hospitalized patients in the U.S. had HAI, compared to 6.5% in the European Union/European Economic Area, and the prevalence is most likely substantially greater globally. Due to a noticeable lack of HAI surveillance systems, the global burden of HAIs is unknown. However, infection prevention and control programs have worked hard to establish surveillance systems and infection control approaches.

The COVID-19 pandemic has presented hospitals with unique challenges in preventing infections. In 2020, hospitals had to cope with a surge in patients, more severe cases, and shortages of staff and supplies. As a result, there was a rise in healthcare-associated infections (HAIs) and increased use of medical devices. According to the National Healthcare Safety Network (NHSN), in 2021, the rates of infections such as ventilator-associated events (VAEs), methicillin-resistant Staphylococcus aureus (MRSA) bacteria, and catheter-associated urinary tract infections (CAUTIs) are predicted to be higher than they were in 2019.

Product Insights

The consumables segment held the largest revenue share of 64% in 2022 and is expected to expand at the fastest CAGR of 7.73% over the forecast period, owing to the rising incidence of HAIs. The most typical form of treatment for nosocomial infections is the administration of antibiotics. Medical examinations assist in identifying the precise microorganisms causing an individual’s ailment.

Common broad-spectrum antibiotics such as penicillin, cephalosporins, tetracyclines, or erythromycin may be used as the first line of treatment. However, when patients with chronic illnesses receive frequent antibiotic medication over extended periods of time, some bacteria are able to increasingly develop a strong resistance to these common antibiotic therapies, thus decreasing their effectiveness.

In 2021, New Zealand conducted its first national survey to study healthcare-associated infections (HAIs) across all 20 of the country’s district health boards. They surveyed 5,469 adult patients in 291 wards across 31 hospitals and discovered 423 active HAIs in 361 patients, resulting in an estimated national prevalence of 6.6%. This means about 6.6% of adult patients had these infections in the country.

The most common types of HAIs were surgical site infections, urinary tract infections, pneumonia, and bloodstream infections. In simple terms, the survey showed that some patients in New Zealand hospitals had infections related to healthcare, with surgical sites, urinary tract, pneumonia, and the bloodstream being the most common sources of the illnesses.

Type Insights

The blood tests segment accounted for the largest revenue share of 66% in 2022 and is expected to advance at the fastest CAGR of 7.09% during the forecast period. The analysis of white cells that fight infection is done using a complete blood count, which helps to monitor the effects of medication therapy on blood cell counts. BD (Becton, Dickinson and Company), one of the leading global medical technology companies, has obtained Emergency Use Authorization (EUA) from the U.S. FDA for its rapid diagnostic test for detecting SARS-CoV-2.

The test is designed to be used at the point of care with the widely accessible BD Veritor Plus System. With results available in just 15 minutes using a portable instrument, this new assay is pivotal in improving access to COVID-19 diagnostics. It allows for real-time results and quick decision-making, right at the testing location.

Regional Insights

Europe dominated the market with the largest revenue share of 35% in 2022, owing to the high disease burden, the availability of infrastructure, increased healthcare expenditure, rapid technological advancements, proactive government initiatives, rise in patient awareness, and the presence of major players. According to an article from the National Center for Biotechnology Information (NCBI), the major subtype of healthcare-associated diseases is urinary tract infections (HTIs). According to regional research, the prevalence of HAUTIs varied from 19.6% in Europe to up to 24% in poor nations in 2019.

Asia Pacific is expected to witness the highest CAGR of 9.05% during the forecast period. The high growth rate can be attributed to the rising disease incidence rate and the high geriatric population in the region. Increasing demand for cost-effective diagnostics and a growing population are among the factors significantly contributing to regional market growth. The rising incidence of HAI in countries such as India and China is expected to boost the industry in the near further.

Key Companies

- BIOMÉRIEUX

- Abbott

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare Private Limited

- BD (Becton, Dickinson and Company)

- Bioscience, Inc.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Meridian Bioscience, Inc.

- Hologic, Inc.

Hospital Acquired Infections Diagnostics Market Report Segmentations:

By Test Type

- Molecular

- Conventional

By Infection Type

- UTI

- Pneumonia

- Surgical Site Infection

- Blood Stream Infections

- Others

By Product

- Consumables

- Instruments

By Type

- Blood Tests

- Urinalysis

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa