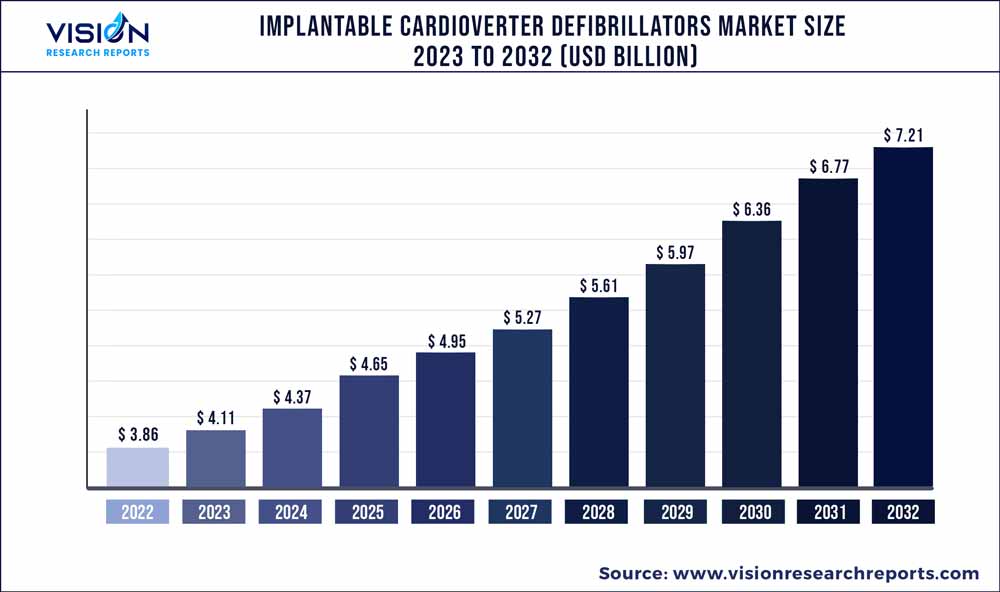

The global implantable cardioverter defibrillators market size was estimated at around USD 3.86 billion in 2022 and it is projected to hit around USD 7.21 billion by 2032, growing at a CAGR of 6.44% from 2023 to 2032. The implantable cardioverter defibrillators market in the United States was accounted for USD 1.3 billion in 2022.

Key Pointers

- North America led the global market with the largest market share of 42% in 2022.

- Asia-Pacific is expected to grow at the fastest CAGR between 2023 to 2032.

- By Product Type, the T-ICDs segment generated the maximum market share of 90% in 2022.

- By Type The, the biventricular devices segment captured the maximum market share of 45% in 2022.

- By NYHA Class, the NYHA Class II segment led the global market with the largest market share of 68% in 2022 and is expected to expand at the highest 6.62% between 2023 to 2032.

- By End-use, the hospitals segment contributed the largest market share of 87% in 2022 and is expected to grow at the fastest CAGR of 6.53% during the forecast period.

The implantable cardioverter defibrillators (ICDs) market is a dynamic and crucial component of the medical device industry, playing a pivotal role in the prevention and management of life-threatening cardiac arrhythmias. This overview aims to provide a comprehensive understanding of the market landscape, highlighting key trends, drivers, challenges, and opportunities that shape the trajectory of this critical healthcare sector.

Get a Sample: https://www.visionresearchreports.com/report/sample/40982

Market Growth

The growth of the implantable cardioverter defibrillators (ICDs) market is propelled by several key factors. Technological innovations play a pivotal role, with continuous advancements in device miniaturization, battery longevity, and remote monitoring capabilities. These innovations enhance the overall performance of ICDs, contributing to increased patient compliance and improved healthcare outcomes. The rising prevalence of cardiovascular disorders globally, coupled with an aging population, further fuels market growth. As the incidence of conditions like ventricular tachycardia and ventricular fibrillation increases, the demand for ICDs as a critical intervention for managing these life-threatening arrhythmias continues to rise. Additionally, heightened awareness and education about the benefits of ICDs among healthcare professionals and the general population foster a proactive approach to cardiovascular health. Overall, the convergence of technological progress, demographic trends, and increased awareness collectively propels the growth trajectory of the implantable cardioverter defibrillators market.

Report Scope of the Implantable Cardioverter Defibrillators Market

| Report Coverage | Details |

| Market Revenue by 2032 | USD 7.21 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.44% |

| Revenue Share of North America in 2022 | 42% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Market Dynamics

Drivers

- Improved Patient Outcomes: The proven efficacy of ICDs in preventing sudden cardiac death and improving overall patient outcomes is a significant driver. Positive clinical outcomes contribute to the acceptance and adoption of ICDs, both by healthcare professionals and patients.

- Stringent Regulatory Standards: Stringent regulatory frameworks governing medical devices, including ICDs, ensure product quality, safety, and efficacy. Compliance with these standards not only ensures market entry but also builds trust among healthcare providers and patients, driving market growth.

Restraints

- Invasive Nature of the Procedure: The implantation process for ICDs involves a surgical procedure, which can be invasive and pose inherent risks. Patient concerns about the invasiveness of the procedure, potential complications, and recovery time may lead to hesitancy in opting for ICDs, impacting market penetration.

- Risk of Infection: The implantation of ICDs carries a risk of infection, a potential complication that can impact patient well-being and require additional medical intervention. Concerns about infection risk may influence both healthcare providers and patients in their decision-making regarding ICD adoption.

Opportunities

- Expanding Applications in Heart Failure Management: The integration of implantable cardioverter defibrillators with Cardiac Resynchronization Therapy (CRT-D) for heart failure management presents a promising avenue for market growth. The dual functionality addresses multiple aspects of cardiac health, catering to a broader patient population and expanding the market reach.

- Rising Global Healthcare Expenditure: The growing global healthcare expenditure, particularly in the cardiovascular care sector, provides a favorable environment for market growth. Increased investments in healthcare infrastructure and resources can contribute to greater accessibility and adoption of advanced medical technologies like ICDs.

Product Type Insights

Based on product type, the ICD market is classified into transvenous implantable cardioverter-defibrillators (T-ICDs) and subcutaneous implantable cardioverter defibrillator segments (S-ICDs). The T-ICDs segment dominated the market with a revenue share of 90% in 2022. The dominant share can be attributed to T-ICDs offering valuable advantages in managing life-threatening ventricular arrhythmias and reducing procedural complications and medical costs associated with invasive surgeries. They address the needs of patients ventricular tachycardia (VT) through features like cardiac resynchronization therapy (CRT), permanent pacing, and anti-tachycardia pacing.

The S-ICDs segment is anticipated to witness the fastest CAGR over the forecast period. This can be attributed to their effectiveness in treating ventricular heart disease and reducing the risk of SCA. S-ICDs offer advantages over traditional T-ICDs by minimizing complications and perioperative issues. They are particularly beneficial for patients with complex anatomies or those who cannot undergo endovascular lead implantation. Clinical trials have demonstrated lower rates of major lead-related complications with S-ICDs, positioning them as an attractive alternative for patients, including young individuals with increased mortality rates post-COVID-19.

Type Insights

Based on type, the ICD market is classified into single-chamber ICDs, dual-chamber ICDs, and biventricular devices segments. The biventricular devices segment led the market with a revenue share of 45% in 2022. Factors such as the growing prevalence of sudden cardiac deaths and its function as a pacemaker and a defibrillator are expected to drive the CRT-D devices demand. The ability to timely report adverse conditions, coupled with the advanced performance of pacing activity, is limiting the mortality rates. On the other hand, key players are focusing on improving these devices. For instance, in March 2019, BIOTRONIK launched the world’s smallest CRT-D and ICD devices in the Europe market. These devices were approved for 3 Tesla full-body MRI scans. Furthermore, technological developments in this segment, such as MRI compatibility, Bluetooth capability, and quadripolar leads, can boost the adoption.For instance, in July 2020, Abbott announced FDA approval for its next-generation Bluetooth-enabled CRT-D and ICD devices.

The dual chamber ICDs are anticipated to witness the fastest CAGR during the forecast period. Due to its indication for patients who require an ICD and cardiac pacing for atrioventricular node and/or sinus node conduction disorders, either due to antiarrhythmic therapy or intrinsic etiology among patients, the market for dual chamber ICDs is anticipated to rise. In addition, according to a 2022 American Medical Association publication, patients with ischemic cardiomyopathy, hypertension, and cerebrovascular illness were more likely to use dual-use ICDs.

NYHA Class Insights

Based on NYHA Class, the market is classified into NYHA Class II and NYHA Class III. The NYHA Class II segment held the largest revenue share of 68% in 2022 and is estimated to grow at the fastest CAGR of 6.62% during the forecast period. The growth of the segment is due to its relevance and effectiveness in treating individuals with NYHA Class II heart failure. NYHA Class II patients experience mild symptoms and limitations during physical activity, making them suitable candidates for ICD devices. The higher proportion of sudden cardiac deaths (SCD) in this class increases the demand for ICDs as a preventive measure. The advantages of S-ICDs, such as minimizing complications and offering a minimally invasive alternative, further contribute to their dominance in the market.

End-use Insights

Based on end-use, the ICD market is classified into hospitals, ambulatory surgical centers, and others. The hospitals segment contributed the largest market share of 87% in 2022 and is expected to grow at the fastest CAGR of 6.53% during the forecast period. The growth of the segment is due to several factors, firstly, hospitals provide superior care to patients, making them a preferred choice for medical procedures.

With the projected increase in cardiovascular disease cases, hospitals are expected to witness lucrative growth in the implantation of defibrillators. The presence of skilled cardiologists and well-equipped facilities in hospitals contributes to the dominance of this segment. In addition, the availability of proper reimbursement facilities and ease of access to treatment attracts a growing number of patients to hospitals. The variation in types of implantations observed in different hospitals further highlights the significance of the hospital segment in the market.

The ambulatory surgical center (ASC) is anticipated to grow at a significant rate during the forecast period. It is owing to the changing regulatory guidelines, reimbursement scenario, and growing government focus on improving patient care in developed countries, which allows efficient care and low-cost treatment options in the ASC.

Regional Insights

North America dominated the global market with the largest market share of 42% in 2022. North America has a well-developed, advanced healthcare infrastructure, including hospitals, clinics, and medical facilities. Furthermore, the region also experiences a high prevalence of CVD, including hypertension, which necessitates the use of ICDs. The presence of key market players like Medtronic, Abbott, and Boston Scientific Corporation further strengthens the market, with Medtronic’s introduction of extravascular ICDs (EV-ICDs) offering promising opportunities. The clinical efficacy of EV-ICDs in treating ventricular arrhythmias and tachycardia compared to traditional T-ICDs and S-ICDs contributes to the market’s growth potential.

However, Asia-Pacific is anticipated to witness the fastest CAGR over the forecast period. The growth is due to the high prevalence of CVDs in countries like China, India, and Japan which contributes to the increasing demand for cardiology medical devices, including ICDs, for diagnosis and treatment. The substantial burden of CVD and related mortalities highlights the need for advanced technologies in this region. Furthermore, companies in China, India, and Japan are actively developing and introducing innovative solutions to address the healthcare burden, driving the growth of the Asia Pacific market.

Key Companies

- Abbott

- Medtronic

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- MicroPort Scientific Corporation.

- LivaNova PLC.

Implantable Cardioverter Defibrillators Market Report Segmentations:

By Product Type

- Transvenous Implantable Cardioverter-Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillators

By Type

- Single Chamber ICDs

- Dual Chamber ICDs

- Biventricular Devices

By NYHA Class

- NYHA Class II

- NYHA Class III

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa