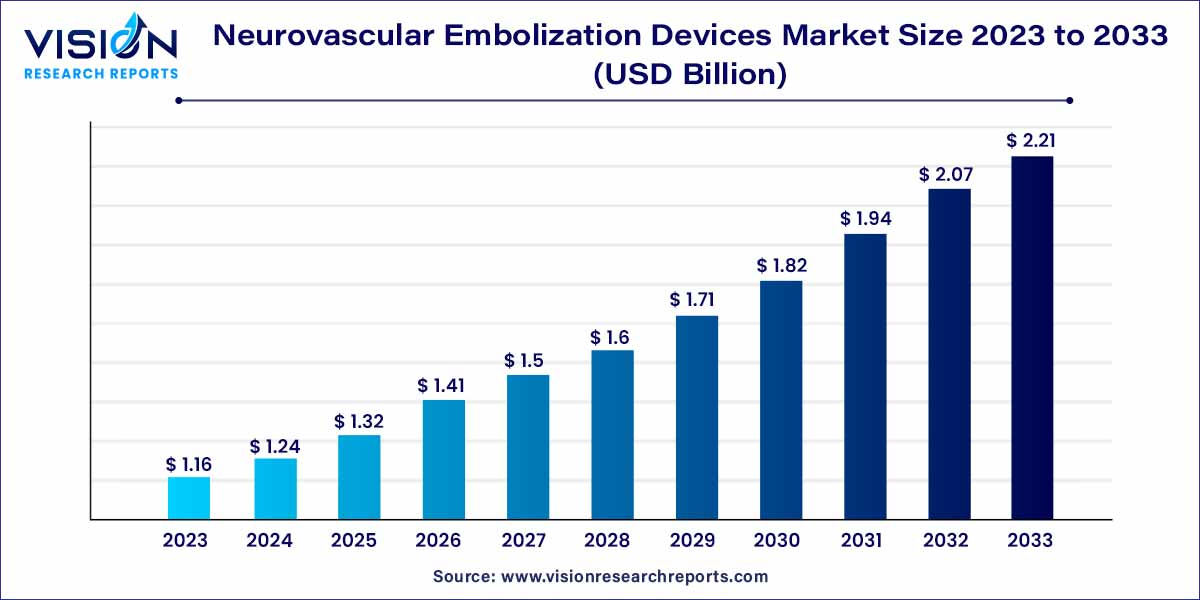

The global neurovascular embolization devices market size was estimated at around USD 1.09 billion in 2022 and it is projected to hit around USD 2.07 billion by 2032, growing at a CAGR of 6.64% from 2023 to 2032. The neurovascular embolization devices market in the United States was accounted for USD 229.1 million in 2022.

Key Pointers

- North America led the global market with the largest market share of 27% in 2022.

- The Asia Pacific market is predicted to grow at the remarkable CAGR during the forecast period.

- By Product, the embolic coils segment dominated the global market with the largest market share of 78% in 2022.

- By Product, the liquid embolic agents segment is expected to grow at the fastest CAGR of 7.75% during the forecast period.

- By End-use, the hospital segment registered the maximum market share of 72% in 2022.

- By End-use, the other segment is predicted to grow at the remarkable CAGR of over the forecast period.

The neurovascular embolization devices market represents a critical segment within the broader medical devices industry, focusing on innovative solutions for cerebrovascular disorders. These disorders, including aneurysms and arteriovenous malformations, demand advanced medical interventions to prevent life-threatening complications. This overview provides a comprehensive insight into the neurovascular embolization devices market, exploring its current status, key players, market drivers, challenges, and future prospects.

Market Growth

The growth of the neurovascular embolization devices market is propelled by several key factors. One of the primary drivers is the increasing prevalence of cerebrovascular disorders globally. As awareness about these conditions rises and diagnostic techniques improve, there is a growing demand for advanced medical interventions, fueling the market expansion. Technological advancements, especially in imaging technologies and materials science, have led to the development of more precise and effective embolization devices. Favorable reimbursement policies and a steady increase in healthcare expenditure worldwide also play a significant role in stimulating market growth. Moreover, continuous investments in research and development by industry players, focusing on innovation and the introduction of minimally invasive techniques, contribute to the market’s positive trajectory. Additionally, strategic collaborations between key market players and healthcare institutions foster innovation and drive the development of safer and more efficient neurovascular embolization devices.

Get a Sample: https://www.visionresearchreports.com/report/sample/40881

Report Scope of the Neurovascular Embolization Devices Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 27% |

| Revenue Forecast by 2032 | USD 2.07 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.64% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Medtronic; Stryker; MicroVention Inc; Cerenovus; Integra LifeSciences; Penumbra Inc; Balt SAS; B. Braun Melsungen AG; Phenox GmbH |

Read More: https://www.heathcareinsights.com/cell-therapy-raw-materials-market/

Market Dynamics

Drivers

- Increasing Prevalence of Cerebrovascular Disorders:

The rising incidence of conditions such as aneurysms and arteriovenous malformations is driving the demand for neurovascular embolization devices.

- Advancements in Diagnostic Technologies:

Technological progress in imaging techniques enables accurate diagnosis, leading to the increased detection of neurovascular disorders and subsequent demand for treatment devices.

Restraints

- Stringent Regulatory Approval Processes:

The neurovascular embolization devices market faces challenges due to rigorous regulatory approval procedures. Ensuring compliance with various regulations and standards can significantly delay the introduction of new devices into the market.

- High Product Costs:

Neurovascular embolization devices often involve sophisticated technologies and materials, making them expensive to produce. High manufacturing costs lead to elevated product prices, limiting accessibility for patients and healthcare facilities, particularly in developing economies.

Opportunities

- Expansion in Emerging Markets:

Emerging economies present untapped markets for neurovascular embolization devices. Increasing healthcare awareness, improving healthcare infrastructure, and rising disposable incomes in these regions create opportunities for market expansion. Strategic market penetration and collaborations with local healthcare providers can facilitate growth.

- Personalized Medicine and Precision Treatments:

Advancements in genomics and personalized medicine open avenues for tailored neurovascular treatments. Customizing embolization devices based on individual patient profiles can enhance treatment outcomes and reduce complications. Companies investing in precision medicine technologies can capitalize on this opportunity.

Challenges

- Potential Adverse Events:

The complex nature of neurovascular interventions carries inherent risks. Adverse events such as device malfunctions, embolization material migration, or procedural complications can occur, raising concerns about the safety of these procedures. Addressing and mitigating these risks are essential for building trust among patients and healthcare providers.

- Competition from Alternative Treatments:

Neurovascular embolization devices face competition from alternative treatments such as surgery, medication, and radiation therapy. Healthcare providers and patients might opt for these established methods over newer, advanced devices, challenging the market adoption of embolization techniques.

Product Insights

The embolic coils segment dominated the global market with the largest market share of 78% in 2022. Embolic coils, intricate devices made of platinum, are deployed within blood vessels to induce clot formation. These coils effectively occlude aneurysms and other vascular abnormalities, preventing the risk of rupture and subsequent hemorrhage. Their popularity stems from their versatility, making them suitable for a wide range of anatomical complexities. The ongoing research and development efforts in the field have led to the creation of detachable and bioactive coils, enhancing their efficacy and safety. Additionally, liquid embolic agents represent a pivotal innovation in neurovascular interventions. These agents, often comprising biocompatible polymers, are injected directly into abnormal blood vessels, solidifying upon contact with blood. This process ensures the targeted occlusion of aneurysms and arteriovenous malformations. Liquid embolic agents offer a distinct advantage by reaching anatomically challenging locations that traditional coils might find difficult to access. Their adaptability and ability to conform to the vessel’s shape make them instrumental in complex cases, providing physicians with a valuable tool to address intricate vascular conditions effectively.

The liquid embolic agents segment is anticipated to grow at the fastest CAGR of 7.75% during the forecast period. liquid embolic agents have witnessed advancements, with the development of new polymers that enhance biocompatibility and reduce the risk of complications. These innovations reflect the industry’s commitment to improving patient outcomes by minimizing procedural risks and maximizing the efficacy of neurovascular embolization procedures. The synergy between research, engineering, and medical expertise has led to a diverse array of embolic coils and liquid embolic agents, each tailored to specific clinical requirements. This diversity enables healthcare professionals to choose the most suitable device, customizing treatments for individual patients. As technology continues to advance, the future of neurovascular embolization devices, especially embolic coils and liquid embolic agents, holds promise for further refinements, ultimately benefiting patients worldwide through safer, more precise, and effective interventions.

End-use Insights

The hospital segment captured the largest revenue share of over 72% in 2022. Hospitals serve as primary hubs for advanced medical procedures, including neurovascular embolization, due to their extensive infrastructure, specialized medical staff, and state-of-the-art equipment. These institutions often house specialized neurointerventional units, equipped with the latest imaging technologies and interventional suites, facilitating precise diagnosis and tailored treatments. The presence of skilled neurosurgeons, interventional radiologists, and neurologists within hospital settings ensures comprehensive and multidisciplinary care for patients suffering from conditions such as aneurysms and arteriovenous malformations. Hospitals not only provide the necessary expertise but also create a controlled environment essential for complex procedures, ensuring patient safety and optimal outcomes.

- For instance, in May 2023, according to a study released in Stroke, reviewed by experts in the largest journal of the American Stroke Association, a branch of the American Heart Association, researchers successfully performed an in-utero surgery in the hospital to treat a severe vascular malformation, known as vein of Galen malformation, in a fetus’s cerebral prior birth to cure a potentially fatal developmental condition.

The other segment is predicted to grow at the remarkable CAGR of over the forecast period. The other segment includes ambulatory surgical centers (ASCs), research and academic institutes. Surgical clinics that offer ambulatory services can perform some neurovascular operations. In some cases, hospitals can be replaced by these facilities more practically and affordably. In some circumstances, ASCs might use neurovascular embolization devices. Moreover, many investigations are conducted by academic and research institutions on neurovascular illnesses, therapeutic approaches, and the development of novel embolization devices. They are vital in developing the knowledge and technology of the manufacturing industry which boost the industry growth.

Regional Insights

North America dominated the global market with the largest market share of 27% in 2022. In North America, particularly in the United States, the market is characterized by a robust demand for advanced medical technologies. The region’s well-established healthcare system, coupled with significant investments in research and development, fosters continuous innovation. Additionally, favorable reimbursement policies and a high prevalence of neurovascular disorders contribute to the market’s growth. North America remains a hub for technological advancements and clinical research, attracting key players and ensuring a steady introduction of novel neurovascular embolization devices.

- For instance, in June 2022, Pipeline Vantage with Shield Technology, a fourth-generation flow deflector with a CE mark by India Medtronic, was developed for endovascular therapy for cerebral aneurysms.

The Asia Pacific market is predicted to grow at the remarkable CAGR during the forecast period. Asia-Pacific emerges as a significant growth frontier for the neurovascular embolization devices market. Countries such as China, Japan, and India witness a rising prevalence of neurovascular disorders due to factors like an aging population and changing lifestyles. In these nations, increasing healthcare expenditure, improving healthcare infrastructure, and growing awareness about advanced treatments drive market expansion. Moreover, local manufacturing capabilities and cost-effective production make Asia-Pacific an attractive region for market players looking to establish a strong foothold.

Neurovascular Embolization Devices Market Segmentations:

By Product

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Aneurysm Clips

By End-use

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/40881

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308