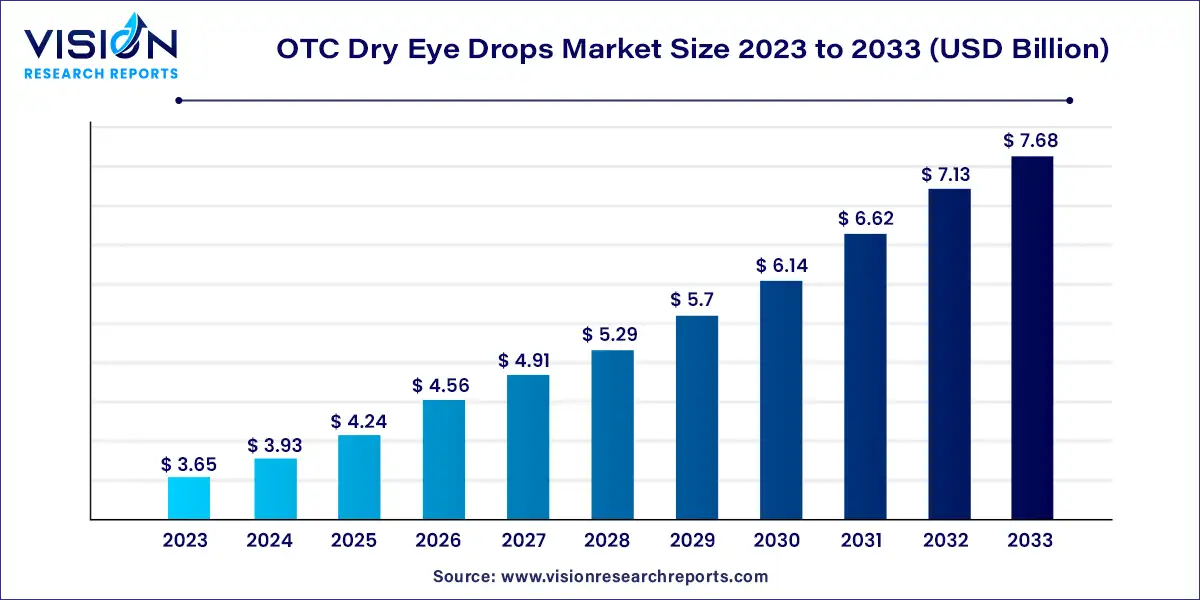

The global OTC dry eye drops market size was estimated at around USD 3.65 billion in 2023 and it is projected to hit around USD 7.68 billion by 2033, growing at a CAGR of 7.72% from 2024 to 2033.

OTC Dry Eye Drops Market Overview

OTC Dry Eye Drops Market Growth

Type Insights

In 2023, the generics segment dominated the market, holding the largest revenue share of 57%. The high share of this segment is primarily due to the cost-effectiveness of generic products. These products are often more affordable than their brand-name counterparts, making them a preferred option in markets where consumers are price-sensitive and seek cost-effective solutions to manage their conditions. Additionally, the ease of purchase further boosts segment growth, as generic products are readily available for purchase without a prescription, making them easily accessible to consumers.

The branded segment is expected to register a lucrative compound annual growth rate (CAGR) over the coming years. Branded products have an established reputation and recognition in the market; therefore, consumers have a higher level of trust and tend to choose products from well-known and reputable brands due to their history of quality and efficacy. Moreover, branded products have unique formulations and delivery methods protected by patents. This exclusivity can give these brands a competitive edge in the market until generics can replicate or improve upon the patented features, thereby contributing to overall growth.

Product Type Insights

Viscosity Insights

In 2023, the low-viscosity segment dominated the market, holding the largest revenue share of 76%. Ease of application and rapid relief are the major factors driving segment growth. Low-viscosity eye drops are often easier to apply due to their thin and watery consistency, making them more comfortable for individuals who may struggle with thicker formulations. Additionally, these eye drops spread quickly across the ocular surface, providing rapid relief to dry and irritated eyes. Moreover, they are better tolerated and easier to use compared to gel drops or ointments.

On the other hand, the high-viscosity segment is expected to witness the fastest compound annual growth rate (CAGR) during the forecast period in the OTC dry eye drops market. High-viscosity eye drops offer a longer duration of effect compared to low-viscosity eye drops, which contributes significantly to overall growth. Furthermore, these eye drops reduce friction, which can lead to inflammation, and minimize vision blurring, thus enhancing ocular comfort.

Distribution Channel Insights

In 2023, the retail pharmacies segment dominated the market, holding the largest revenue share of 41%. Accessibility and convenience play a crucial role in contributing to the segment’s growth. Retail pharmacies, including chain pharmacies and independent drugstores, are widely distributed and easily accessible to consumers. They are often conveniently located in neighborhoods, shopping centers, and healthcare facilities, making it effortless for consumers to purchase OTC products like dry eye drops. Moreover, retail pharmacies offer one-stop shopping for a wide range of healthcare products, including OTC medications, supplements, personal care items, and more. This convenience encourages consumers to buy more products from retail pharmacies, thereby contributing to the growth of the segment.

The online pharmacies segment is expected to witness the highest compound annual growth rate (CAGR) of 13.44% during the forecast period. Online pharmacies save consumers time by eliminating the need to travel to a physical pharmacy. Thus, the time-saving factor contributes to the segment’s growth. Moreover, the COVID-19 pandemic further accelerated the adoption of online pharmacies, as consumers sought ways to minimize physical interactions and reduce the risk of exposure to the virus.

Regional Insights

Read More: https://www.heathcareinsights.com/u-s-sternal-closure-systems-market/

OTC Dry Eye Drops Market Key Companies

- Rohto Pharmaceutical Co. Ltd.

- AbbVie, Inc.

- Johnson & Johnson Services Inc.

- Santen Pharmaceutical Co. Ltd.

- Novartis AG

- Prestige Consumer Healthcare Inc.

- Altaire Pharmaceuticals Inc.

- Sentiss Pharma Private Limited

- Medicom Healthcare Ltd.

OTC Dry Eye Drops Market Segmentations:

By Type

- Branded

- Generics

By Product Type

- With Preservatives

- Preservatives Free

By Viscosity

- Low Viscosity

- High Viscosity

By Distribution Channel

- Drugstores and Supermarkets

- Online Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/40835

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308