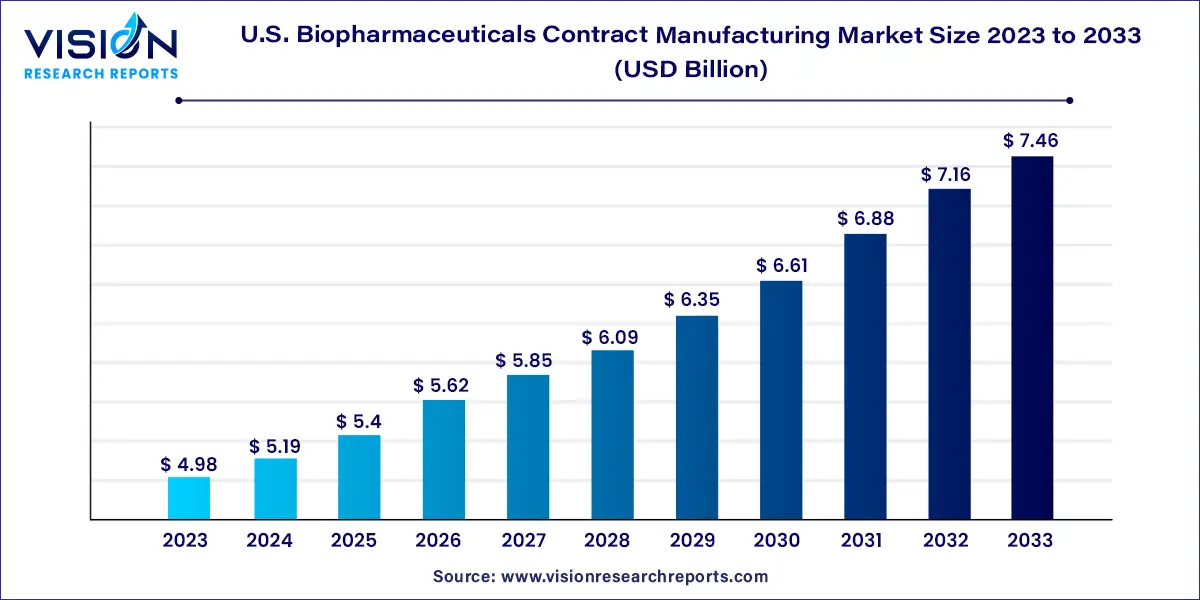

The U.S. biopharmaceuticals contract manufacturing market size was estimated at around USD 4.98 billion in 2023 and it is projected to hit around USD 7.46 billion by 2033, growing at a CAGR of 4.12% from 2024 to 2033.

U.S. Biopharmaceuticals Contract Manufacturing Market Overview

U.S. Biopharmaceuticals Contract Manufacturing Market Growth

U.S. Biopharmaceuticals Contract Manufacturing Market Trends:

Source Insights

In 2023, the mammalian source segment dominated with the highest share at 57%, mainly driven by the elevated costs associated with acquiring products from these sources. Key players offering contract services utilizing mammalian cell culture, such as AbbVie Contract Manufacturing, AMRI, Avid Bioservices, Boehringer Ingelheim Biopharmaceuticals Gmbh, and Catalent Pharma Solutions, contributed to this growth. Consequently, industry leaders like Lonza and Charles River Laboratories are making significant investments to expand their manufacturing facilities for mammalian cell culture, specifically tailored for biologics and biosimilar development.

On the other hand, the non-mammalian segment is poised to experience the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. The widely adopted non-mammalian cell culture for biopharmaceutical production is non-mammalian cell line E. coli, recognized for its rapid accessibility and cost-effective cultivation. The development of transgenic non-mammalian expression systems presents an opportunistic avenue for market expansion. Notable Contract Manufacturing Organizations (CMOs) utilizing microbial cultures include Abbott Bioresearch, Avecia Biotechnology, BioReliance, Biovitrum AB, Dow Pharmaceutical, and Celltrion.

Service Insights

Product Insights

In 2023, the biologics product segment emerged as the market leader, commanding a dominant share of over 82%. Contract manufacturers have played a crucial role in the success of both biologics and biosimilars, a trend underscored by the substantial commercial success of biologics, evident from the presence of numerous FDA-approved biologics in the market. Within the biologics category, Monoclonal Antibodies (MAb) led the pack in 2023, capturing the largest market share. The significant capital investment required for establishing a MAb plant has accelerated the adoption of contract services for MAb production, contributing significantly to the segment’s predominant share.

The biosimilar segment is poised for notable growth from 2024 to 2033. Biosimilar production is seen as a key strategy for business expansion, offering a faster market reach for biopharmaceuticals compared to biologics. Additionally, biosimilars have been instrumental in supporting the biopharmaceutical Contract Manufacturing Organization (CMO) industry, thanks to their cost-saving advantages. The combination of lower production costs and the increasing expiration of patents for blockbuster biologics has further intensified the demand for manufacturing services, including outsourced services.

Read More: https://www.heathcareinsights.com/u-s-veterinary-telehealth-market/

U.S. Biopharmaceuticals Contract Manufacturing Market Key Companies

- Lonza

- WuXi Biologics

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Boehringer Ingelheim

- Thermo Fisher Scientific Inc.

- Samsung BioLogics

- AGC Biologics

- Catalent Pharma Solutions

- Rentschler Biopharma SE

- Eurofins Scientific SE

Recent Developments

- In April 2022, Lonza extended the capability of its Coccon platform used in the manufacturing of automated cell therapy. The new capabilities included integrated capabilities in cell separation, cell binding, and bead removal.

- In March 2022, Cambrex, expanded its biopharmaceutical testing services business with the addition of 11 cGMP laboratories in its U.S. facility. The expansion included the addition of instruments for nanoparticle size analysis, qPCR, imaging, mass spectrometry, immunoblotting, and next-generation sequencing, as well as for other applications.

- In February 2022, Thermo Fisher Scientific, Inc. invested $40 million to build a bioprocessing manufacturing site in Millersburg, Pennsylvania for developing critical vaccines and biologics.

U.S. Biopharmaceuticals Contract Manufacturing Market Segmentations:

By Source

- Mammalian

- Non-mammalian

By Service

- Process Development

- Downstream

- Upstream

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

By Product

- Biologics

- Monoclonal antibodies (MABs)

- Recombinant Proteins

- Vaccines

- Antisense, RNAi, & Molecular Therapy

- Others

- Biosimilar

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41212

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308