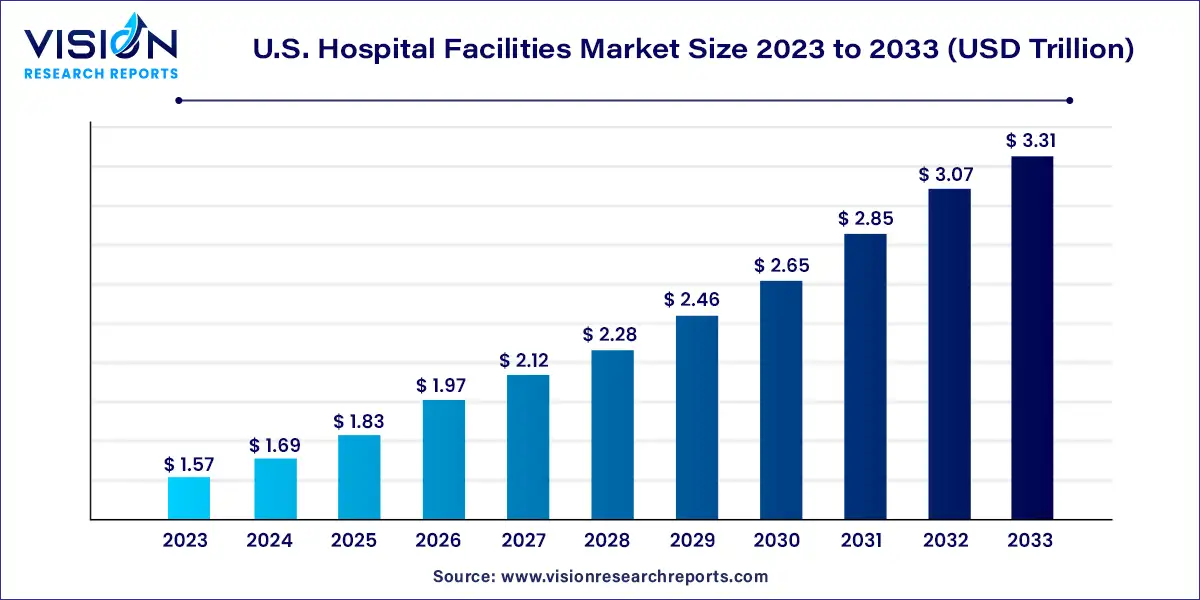

The U.S. hospital facilities market was estimated at USD 1.57 trillion in 2023 and it is expected to surpass around USD 3.31 trillion by 2033, poised to grow at a CAGR of 7.73% from 2023 to 2032.

U.S. Hospital Facilities Market Overview

U.S. Hospital Facilities Market Growth

The U.S. hospital facilities market is experiencing significant growth, propelled by several key factors. Firstly, there’s a rising demand for healthcare services due to population growth, aging demographics, and the increasing prevalence of chronic diseases. This demand is driving the expansion of hospital facilities nationwide. Additionally, advancements in medical technology and treatment methods require infrastructure upgrades and the establishment of specialized facilities to meet evolving patient needs.

Moreover, government initiatives aimed at enhancing healthcare access, such as the Affordable Care Act, have spurred investment in hospital infrastructure development. Furthermore, there’s a growing focus on patient-centered care and achieving quality outcomes, prompting hospitals to invest in cutting-edge facilities equipped with advanced amenities and technology. Lastly, strategic partnerships and mergers within the healthcare industry are facilitating consolidation and encouraging investment in modernizing existing hospital facilities to improve operational efficiency and patient satisfaction.

Get Sample Copy@ https://www.visionresearchreports.com/report/sample/40834

U.S. Hospital Facilities Market Trends

- Emphasis on Telemedicine: The adoption of telemedicine continues to grow, driven by technological advancements and the need for remote healthcare services, especially in rural areas. Hospitals are integrating telemedicine capabilities into their facilities to provide virtual consultations, remote monitoring, and telehealth services, enhancing access to care and improving patient outcomes.

- Focus on Patient Experience: Hospitals are prioritizing patient-centered care by redesigning facilities to enhance the overall patient experience. This includes creating healing environments with comfortable amenities, private rooms, and integrated technology to empower patients and improve satisfaction levels.

- Integration of Smart Technology: The incorporation of smart technology is revolutionizing hospital facilities, enabling efficient operations and better patient care. From electronic health records (EHR) systems to IoT-enabled medical devices and automated workflow solutions, hospitals are leveraging technology to streamline processes, reduce errors, and enhance communication among healthcare teams.

Patient Service Insights

Service Type Insights

The market is segmented based on service type into acute care, cardiovascular, cancer care, neurorehabilitation & psychiatry services, pathology lab, diagnostic, and imaging, obstetrics & gynecology, and others. The cardiovascular segment emerged as the market leader in 2023, capturing a market share of 22%. It is projected to maintain its dominance throughout the forecast period. The prevalence of a sedentary lifestyle has contributed to a rise in obesity rates in the U.S., increasing the risk of heart disease. Consequently, the growing number of patients affected by cardiovascular diseases (CVDs) is expected to drive growth in this segment.

The cancer care segment is poised to witness a significant compound annual growth rate (CAGR) over the forecast period. Cancer ranks as the second leading cause of death in the U.S., following CVD. The recurrent nature of the disease and the need for frequent chemotherapy sessions contribute to an increase in hospitalizations related to cancer. According to the American Cancer Society, approximately 1.9 million new cancer cases are projected to be diagnosed in the U.S. in 2022. Factors such as the rising cost of cancer treatment, the expansion of specialized oncology departments and oncologists, and a supportive reimbursement framework are expected to drive growth in this segment.

Bed Size Insights

The market is segmented based on bed size into categories including 0-99, 100-199, 200-299, and 300-more. The 0-99 segment held the largest revenue share of the market in 2023, accounting for 55%. This segment encompasses small hospitals primarily serving rural or remote areas with low population density. While these hospitals focus on providing basic healthcare services to communities, some within this segment also cater to specialized needs based on the local population. Their main objective is to deliver essential medical care.

On the other hand, the 300 and more segment is expected to experience a promising compound annual growth rate (CAGR) over the forecast period. Equipped with modern technology, specialized medical staff, and research capabilities, these hospitals drive advancements in medical science. These factors contribute to the growth of this segment.

Facility Type Insights

Read More: https://www.heathcareinsights.com/otc-dry-eye-drops-market-size-to-hit-usd-7-68-bn-by-2033/

U.S. Hospital Facilities Market Key Companies

- The Johns Hopkins Hospital

- Mayo Clinic

- Cleveland Clinic

- Cedars-Sinai

- Massachusetts General Hospital

- UCSF Health

- NewYork-Presbyterian Hospital

- Brigham and Women’s Hospital

- Ronald Regan UCLA Medical Center

- Northwestern Memorial Hospital

U.S. Hospital Facilities Market Segmentations:

By Patient Service

- Inpatient

- Outpatient

By Facility Type

- Private Hospitals

- State Owned & Federal Hospitals

- Public/Community Hospitals

By Service Type

- Acute Care

- Cardiovascular

- Cancer Care

- Neurorehabilitation & Psychiatry Services

- Pathology Lab, Diagnostics, and Imaging

- Obstetrics & Gynecology

- Others

By Bed Size

- 0-99

- 100-199

- 200-299

- 300-more

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/40834

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308