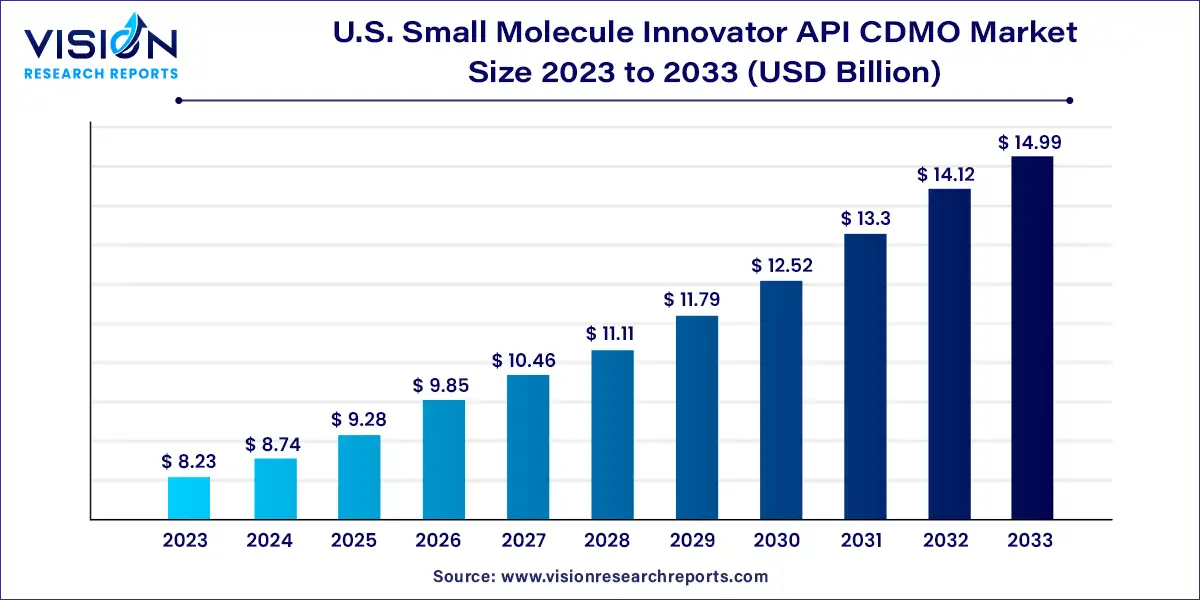

The U.S. small molecule innovator API CDMO market size was estimated at around USD 8.23 billion in 2023 and it is projected to hit around USD 14.99 billion by 2033, growing at a CAGR of 6.18% from 2024 to 2033.

Key Pointers

- By Stage Type, the clinical segment contributed the largest market share of 55% in 2023.

- By Stage Type, the preclinical segment is estimated to expand the fastest CAGR from 2024 to 2033.

- By Therapeutic Area, the oncology segment registered the maximum market share of 43% in 2023.

- By Customer Type, the pharmaceutical companies contributed more than 92% of revenue share in 2023.

Get a Sample@ https://www.visionresearchreports.com/report/sample/41406

Introduction to the U.S. Small Molecule Innovator API CDMO Market

The U.S. Small Molecule Innovator API CDMO (Active Pharmaceutical Ingredient Contract Development and Manufacturing Organization) market plays a crucial role in the pharmaceutical industry. As pharmaceutical companies increasingly focus on developing innovative therapies, the demand for specialized API CDMO services has surged.

Impact of COVID-19 on the Market

The COVID-19 pandemic caused short-term disruptions in the supply chain and clinical trials, highlighting vulnerabilities in global healthcare systems. However, it also accelerated digital transformation and adoption of remote monitoring technologies, paving the way for a more resilient API CDMO sector.

U.S. Small Molecule Innovator API CDMO Market Dynamics

Drivers

- Increasing Demand for Personalized Medicines

- The shift towards personalized medicine continues to drive demand for specialized APIs that can cater to individual patient needs.

- APIs developed by CDMOs enable pharmaceutical companies to create tailored therapies with precise dosages and formulations.

- Technological Advancements in API Manufacturing

- Advances in synthetic chemistry, automation, and artificial intelligence (AI) have significantly enhanced the efficiency and speed of API production.

- Continuous manufacturing processes and biocatalysis are revolutionizing how APIs are synthesized, reducing production costs and time-to-market.

- Regulatory Advancements and Market Expansion

- Favorable regulatory frameworks in the U.S., including streamlined FDA approvals and stringent quality standards, support market growth.

- Market expansion into niche therapeutic areas such as oncology and rare diseases presents new opportunities for API CDMOs to innovate and capture market share.

Challenges

- Regulatory Compliance and Quality Assurance

- Meeting stringent regulatory requirements for safety, efficacy, and quality poses significant challenges for API CDMOs.

- Continuous adherence to evolving regulatory standards requires substantial investment in compliance and quality assurance measures.

- Competitive Pricing and Market Competition

- Intense competition among API CDMOs necessitates competitive pricing strategies to attract and retain pharmaceutical clients.

- Price pressures can impact profitability and necessitate operational efficiencies to maintain competitive advantage.

- Technological and Operational Risks

- Dependency on advanced technologies such as AI and automation introduces risks related to cybersecurity, operational disruptions, and technological obsolescence.

- Managing these risks while leveraging technological innovations remains a critical challenge for API CDMOs.

Opportunities

- Expansion in Biopharmaceuticals and Specialty Therapeutics

- The growing pipeline of biopharmaceuticals and specialty therapeutics presents lucrative opportunities for API CDMOs.

- Customized APIs for complex biologics and orphan drugs cater to niche markets with high unmet medical needs.

- Investment in Sustainable Manufacturing Practices

- Increasing emphasis on sustainable practices in API manufacturing, including green chemistry and waste reduction, aligns with global environmental goals.

- Adoption of sustainable technologies enhances corporate social responsibility and appeals to environmentally conscious pharmaceutical clients.

- Strategic Partnerships and Collaborations

- Strategic alliances between innovator companies and API CDMOs enhance capabilities and expand market reach.

- Collaborative efforts in research and development foster innovation and enable API CDMOs to offer comprehensive solutions from development to commercialization.

U.S. Small Molecule Innovator API CDMO Market Key Companies

- Lonza Group Ltd.

- Novo Holdings (Catalent, Inc.)

- Thermo Fisher Scientific, Inc.

- Siegfried Holding AG

- Recipharm AB

- CordenPharma International

- Samsung Biologics

- Labcorp

- Ajinomoto Bio-Pharma Services

- Piramal Pharma Solutions

- Jubilant Life Sciences (Jubilant Biosys Limited)

- WuXi AppTec Co., Ltd.

U.S. Small Molecule Innovator API CDMO Market Segmentation:

By Stage Type

- Preclinical

- Clinical

- Phase I

- Phase II

- Phase III

- Commercial

By Customer Type

- Pharmaceutical

- Small

- Medium

- Large

- Biotechnology

- Small

- Medium

- Large

By Therapeutic Area

- Cardiovascular Diseases

- Oncology

- Respiratory Disorders

- Neurology

- Metabolic Disorders

- Infectious Diseases

- Others

By Region

- Northeast

- New Jersey

- New York

- Midwest

- Illinois

- Missouri

- West Group

- California

- Washington

- South

- Texas

- Florida

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41406

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308