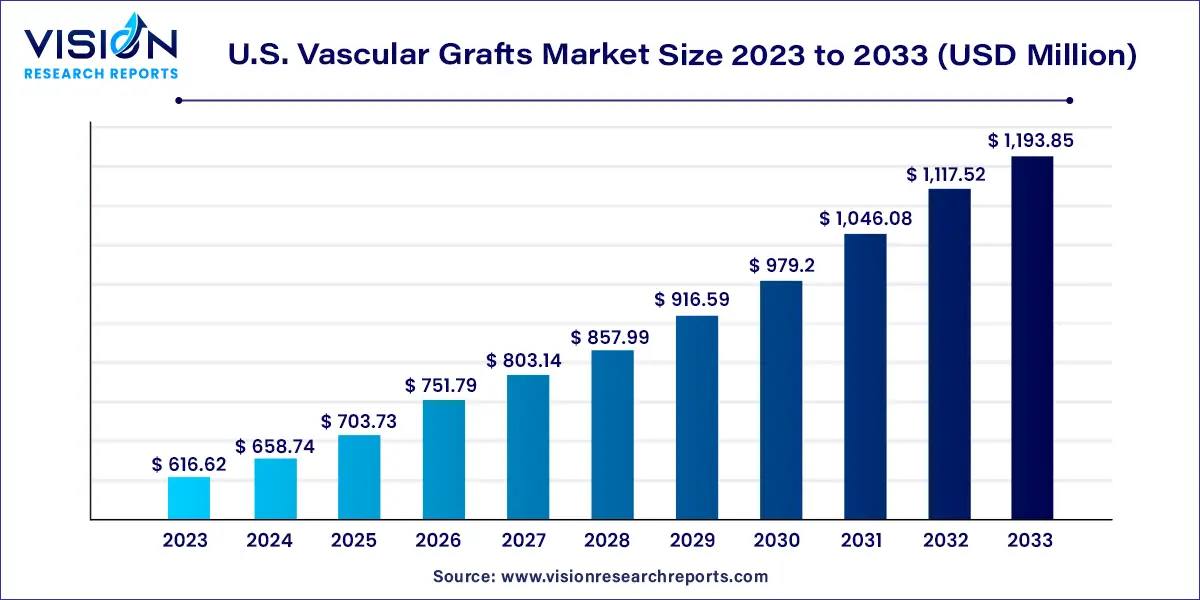

The U.S. vascular grafts market size was estimated at around USD 616.62 million in 2023 and it is projected to hit around USD 1,193.85 million by 2033, growing at a CAGR of 6.83% from 2024 to 2033.

U.S. Vascular Grafts Market Overview

U.S. Vascular Grafts Market Growth

The growth of the U.S. Vascular Grafts market is influenced by several key factors. Technological advancements play a pivotal role, as ongoing innovations in graft materials and design contribute to enhanced performance and durability, thereby driving increased demand. Additionally, the rising prevalence of vascular diseases in the U.S. population, coupled with the aging demographic, serves as a significant growth driver.

The expanding incidence of cardiovascular diseases and peripheral vascular disorders underscores the crucial role vascular grafts play in addressing these health challenges. Despite regulatory complexities and the high cost associated with advanced grafts presenting challenges, they also create opportunities for market players to innovate, expand their market reach, and ultimately improve patient outcomes.

As a result, the U.S. vascular grafts market is poised for continued growth, fueled by a combination of technological advancements and the evolving healthcare needs of the population.

U.S. Vascular Grafts Market Trends:

- Increased Adoption of Synthetic Grafts: Synthetic vascular grafts are witnessing a surge in adoption due to their versatility, durability, and reduced risk of infection. The market trend leans towards the preference for synthetic materials, driven by advancements in biomaterials and manufacturing processes.

- Growing Emphasis on Endovascular Procedures: The market is experiencing a shift towards minimally invasive endovascular procedures. The demand for endovascular techniques, including stent grafts and endovascular aneurysm repair (EVAR), is rising, reflecting a preference for less invasive interventions and quicker patient recovery.

- Rising Application in Aneurysm Repair: Aneurysm repair represents a significant application area for vascular grafts, with an increasing focus on developing grafts tailored for this specific purpose. The market is witnessing a trend of specialized grafts designed to address the unique challenges posed by aneurysm repair procedures.

- Integration of Biocompatible Materials: The market is witnessing a notable trend towards the incorporation of biocompatible materials in vascular grafts. This shift is driven by the desire to minimize immune responses, promote tissue integration, and enhance overall biocompatibility, ultimately improving patient outcomes.

Application Insights

In 2023, the cardiac aneurysm segment emerged as the leader in the vascular grafts market, commanding a substantial 52% of the revenue share. This dominance is attributed to the increasing incidence of cardiovascular diseases and advancements in developing sophisticated tissue-engineered grafts for pediatric congenital heart surgeries. The market is poised for further growth, driven by factors such as the introduction of innovative prosthetic grafts with enhanced porosity and efficiency, coupled with an increasing acceptance of these grafts. Additionally, the prevalence of unruptured saccular aneurysms impacting intracranial artery flow is expected to contribute to the expanding market for vascular grafts throughout the forecast period.

Notably, the vascular occlusion segment is anticipated to experience the highest growth in the upcoming forecast period. The surge is fueled by the escalating prevalence of vascular occlusive diseases and the convenient accessibility of graft procedures, particularly those involving the saphenous vein graft. Technological progressions leading to the emergence of novel therapies, such as warfarin, designed to mitigate the severity of acute ischemia following PTFE graft occlusion, are expected to reduce risks associated with prosthetic vascular grafts. Consequently, this development is projected to bolster the adoption of vascular grafts over the forecast period.

Raw Materials Insights

In 2023, the polytetrafluoroethylene (PTFE) vascular grafts segment emerged as the leader in the vascular grafts market, commanding a substantial 46% of the revenue share. This dominance is primarily driven by the escalating demand for cutting-edge engineered prosthetics and technologically advanced products. The noteworthy factors contributing to the largest share in this segment include the heightened demand for novel engineered prosthetics and technologically advanced products. Additionally, the low risk of degradation and infection associated with polytetrafluoroethylene grafts significantly contributes to their market dominance.

PTFE, designed with advanced technology, exhibits characteristics such as minimal blood loss, high delamination resistance, and applicability in extra-anatomical procedures and peripheral bypasses. Consequently, PTFE vascular grafts are poised to gain more market share throughout the forecast period.

Concurrently, the polyester vascular grafts segment is anticipated to witness substantial growth in the forecast period. This growth can be attributed to factors such as the easy availability of raw materials, high tensile strength, and remarkable durability of polyester grafts. Moreover, the widespread use of Dacron durable polyester, infused with mitogenic properties, and the increasing number of clinical trials aimed at developing highly durable polyester grafts are expected to propel market growth over the forecast period.

Product Insights

In 2023, the endovascular stent grafts segment emerged as the frontrunner in the vascular grafts market, commanding a significant 65% of the revenue share. This leadership is a consequence of the escalating number of abdominal aortic aneurysm procedures, coupled with a reduced potential for access-site complications. Additionally, the lower mortality rate associated with endovascular stent graft treatment and ongoing technological advancements in novel product development are key factors expected to positively impact market growth throughout the forecast period.

Moreover, these stent-grafts, when combined with antibiotics, present an alternative treatment for mycotic aneurysms. Given the prolonged duration and excessive blood loss associated with open surgeries, the demand for minimally invasive endovascular stent grafts is anticipated to gain substantial momentum in the coming forecast period.

Concurrently, the peripheral vascular grafts segment is poised to experience significant growth in the forecast period. This growth is primarily driven by the diverse range of medical applications and advancements in intraoperative techniques. The increasing prevalence of Peripheral Artery Diseases (PADs) stands out as a key factor contributing to market expansion. Anticipated technological advancements in developing novel products for PAD treatment are expected to fuel demand for peripheral vascular grafts in the forecast period.

Read More: https://www.heathcareinsights.com/u-s-plasmid-dna-contract-manufacturing-market/

U.S. Vascular Grafts Market Key Companies

- Medtronic

- Terumo Corporation

- LeMaitre Vascular, Inc.

- Getinge AB

- BD (Becton Dickinson)

- Abbott

- B. Braun Melsungen AG.

- Abbott

- W. L. Gore and Associates, Inc.

- MicroPort Scientific Corporation

- Endologix

Recent Developments

- In February 2024, Gore announced the FDA approval of its latest VBX stent graft, featuring a lower-profile design. This innovative device combines flexibility, strength, and precision in deployment, making it especially effective for treating complex cases.

- In October 2023, the company revealed FDA clearance for its groundbreaking product, DuraGraft. This first-in-class solution is designed as a vascular conduit for adult patients undergoing Coronary Artery Bypass Grafting (CABG) surgeries. DuraGraft serves the purpose of flushing and storing saphenous vein grafts utilized in CABG procedures.

- In March 2021, Vascular Grafts Solutions Ltd. secured FDA clearance for its new device named Viola. Specifically developed for clampless proximal anastomosis in coronary artery bypass grafting (CABG), Viola represents an advancement in surgical solutions for this critical cardiovascular procedure.

U.S. Vascular Grafts Market Segmentations:

By Product

- Hemodialysis Access Grafts

- Endovascular Stent Grafts

- Coronary Artery By-Pass Grafts

- Vascular Grafts for Aorta Disease

- Peripheral Vascular Grafts

By Application

- Cardiac Aneurysm

- Endovascular Stent Graft

- Vascular Graft

- Kidney Failure

- Vascular Occlusion

- Coronary Artery Disease

By Raw Material

- Synthetic Vascular Grafts

- Polytetrafluoroethylene (PTFE) Grafts

- Polyester Grafts

- Polyurethane Grafts

- Biological Vascular Grafts

- Autografts

- Allografts

- Xenografts

- Hybrid Vascular Grafts

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41214

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308