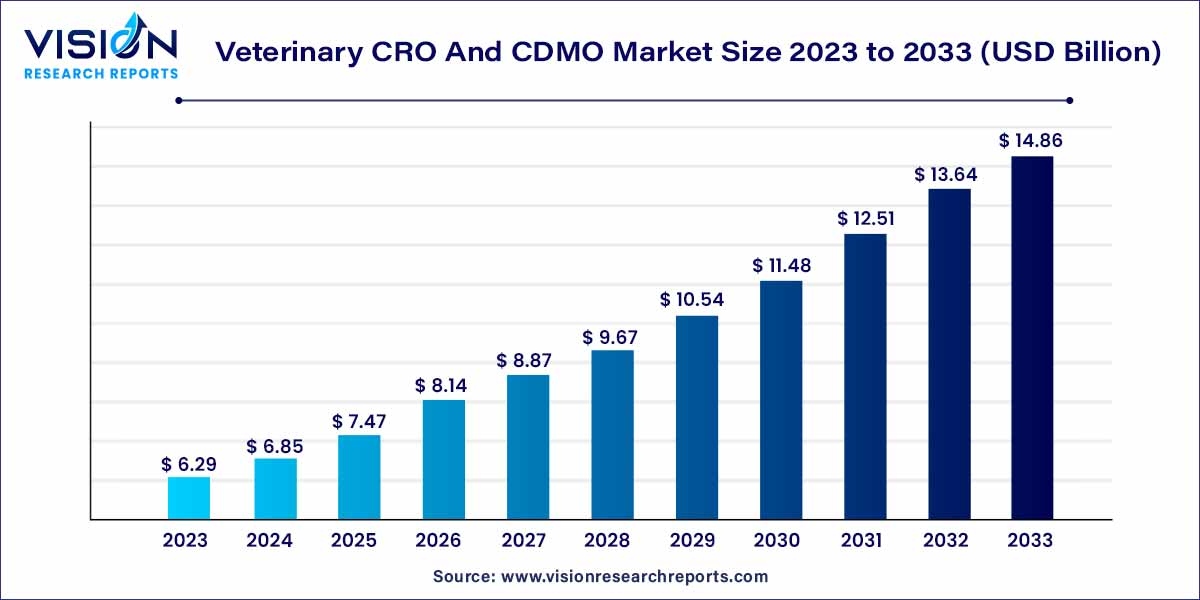

The global veterinary CRO and CDMO market was estimated at USD 5.87 billion in 2022 and it is expected to surpass around USD 13.87 billion by 2032, poised to grow at a CAGR of 8.98% from 2023 to 2032. The veterinary CRO and CDMO market in the United States was accounted for USD 1.7 billion in 2022.

Key Pointers

- North American region led the global market with the largest market share of 31% in 2022.

- The Asia Pacific region predicted to grow at the fastest CAGR during the forecast period.

- By Animal Type, the livestock animal segment generated the highest market share of 41% in 2022.

- By Animal Type, the companion animal segment is anticipated to grow at the fastest CAGR during the projected period.

- By Service Type, the development segment contributed more than 31% of revenue share in 2022.

- By Application, the medicine segment registered the highest market share of 63% in 2022.

The Veterinary contract research organization (CRO) and contract development and manufacturing organization (CDMO) market is a dynamic sector within the pharmaceutical industry, specifically tailored to the field of veterinary medicine. These organizations provide essential services to pharmaceutical companies and biotechnology firms dedicated to the development, research, and manufacturing of veterinary drugs and treatments.

Market Growth

The growth of the veterinary contract research organization (CRO) and contract development and manufacturing organization (CDMO) market can be attributed to several key factors. Firstly, the increasing prevalence of animal diseases has led to a heightened demand for specialized veterinary drugs and treatments. This rising need for effective pharmaceutical solutions propels the demand for research and development services offered by Veterinary CROs and CDMOs. Secondly, advancements in veterinary medicine and biotechnology have created opportunities for innovative drug discovery and manufacturing techniques. CROs and CDMOs, equipped with state-of-the-art technologies, are well-positioned to capitalize on these opportunities, driving market growth. Additionally, stringent regulatory standards governing the production of veterinary pharmaceuticals necessitate the expertise of CROs and CDMOs to ensure compliance, further boosting their significance in the industry. Furthermore, the growing pet population worldwide and the increasing awareness about animal health have amplified the demand for high-quality veterinary products. As a result, pharmaceutical companies are increasingly relying on CROs and CDMOs to enhance their research capabilities and deliver safe, efficacious, and innovative veterinary drugs, fostering the expansion of the Veterinary CRO and CDMO market.

Get a Sample: https://www.visionresearchreports.com/report/sample/40891

Report Scope of the Veterinary CRO And CDMO Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 31% |

| Revenue Forecast by 2032 | USD 1413.27 billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.75% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Labcorp Drug Development; Charles River Laboratories.; Clinvet; KLIFOVET GmbH (Argenta Group); OCR – Oncovet Clinical Research; Knoell – Triveritas; Veterinary Research Management; VETSPIN; Inotiv.; IDEXX Laboratories; Zoetis – Nexvet; Vetio |

Read More: https://www.heathcareinsights.com/data-monetization-solutions-for-life-science-companies-market/

Market Dynamics

Drivers

Increasing Prevalence of Animal Diseases:

The rising incidence of various animal diseases, both in companion and livestock animals, necessitates the development of specialized pharmaceuticals, driving the demand for CRO and CDMO services.

Advancements in Veterinary Medicine:

Continuous advancements in veterinary medicine and biotechnology have opened new avenues for drug discovery and development. CROs and CDMOs leverage these innovations, leading to the creation of novel veterinary drugs and therapies.

Restraints

High Research and Development Costs:

Conducting extensive research and clinical trials in the veterinary pharmaceutical sector incurs significant costs. High expenses related to R&D act as a major restraint, particularly for smaller pharmaceutical companies and startups, limiting their ability to engage CRO and CDMO services.

Stringent Regulatory Challenges:

While regulations ensure the safety and efficacy of veterinary drugs, navigating through complex regulatory pathways can be arduous. Compliance with diverse international standards poses a challenge, making the approval process time-consuming and costly for companies and CRO/CDMO providers alike.

Opportunities

Personalized Veterinary Medicine:

Similar to personalized medicine in human healthcare, there is a rising interest in tailored treatments for animals. CROs and CDMOs can capitalize on this trend by developing personalized veterinary drugs, customized based on individual animal genetics and characteristics.

Regulatory Support Services:

As regulatory requirements continue to evolve, there is a growing demand for consultancy and support services. CROs and CDMOs can diversify their offerings to include regulatory consulting, helping pharmaceutical companies navigate complex approval processes and ensuring compliance with changing regulations.

Challenges

Ethical Concerns and Animal Welfare:

Ethical considerations regarding animal testing and welfare pose a significant challenge. Balancing the necessity of research with ethical treatment of animals raises debates and potential restrictions on certain testing practices, impacting the research and development processes.

Supply Chain Disruptions:

Global supply chain disruptions, caused by factors such as natural disasters, geopolitical tensions, or pandemics, can impact the procurement of raw materials and the distribution of finished products. These disruptions can lead to delays in drug development and manufacturing processes, affecting timelines and costs.

Animal Type Insights

The livestock animal segment captured the maximum market share of 41% in 2022. The livestock animal segment plays a vital role in the global economy, encompassing animals such as cattle, poultry, swine, and aquaculture species. Livestock animals are a source of meat, milk, eggs, and other essential products. Ensuring the health and well-being of livestock is crucial for food safety and security. Veterinary CROs and CDMOs collaborate with agricultural and animal husbandry industries to develop vaccines, antibiotics, and other pharmaceuticals to prevent and treat diseases in livestock. Additionally, these organizations focus on improving the efficiency of animal production, enhancing the quality of animal-derived products, and promoting sustainable farming practices.

- For instance, on July 2022, the USDA’s National Agricultural Statistics Service reported that the overall expenditure on farms in the U.S. exceeded USD 390 Billion in 2021, 7.3% up from 2020.

The companion animal segment is expected to grow at the fastest CAGR during the projected period. Companion animals, including pets like dogs, cats, birds, and small mammals, represent a substantial portion of the veterinary pharmaceutical market. As pet ownership continues to rise worldwide, there is an increasing demand for specialized veterinary drugs and therapies for these animals. This trend has led to significant investments in research and development activities focused on companion animals, with pharmaceutical companies partnering with CROs and CDMOs to formulate innovative and effective treatments.

Service Type Insights

The development segment generated the largest revenue share of 31% in 2022. Development services offered by Veterinary CROs are multifaceted and play a pivotal role in the early stages of pharmaceutical innovation. CROs engage in comprehensive pre-clinical research, involving laboratory testing and animal studies, to evaluate the efficacy and safety of potential drug candidates. Through meticulous clinical trials, these organizations assess the performance of new compounds, ensuring they meet regulatory standards and are suitable for animal use. CROs also provide invaluable support in regulatory affairs, navigating the complex landscape of approvals and compliance. Additionally, their expertise extends to formulation development, optimizing the delivery mechanisms of drugs for maximum effectiveness.

Veterinary CDMOs specialize in the manufacturing phase, translating research findings into tangible pharmaceutical products. These organizations are equipped with cutting-edge facilities for large-scale production, adhering to stringent quality control measures throughout the manufacturing process. From formulation scaling and analytical testing to packaging and distribution, CDMOs ensure that the drugs are manufactured efficiently, meeting the highest industry standards. By integrating advanced technologies and adhering to Good Manufacturing Practices (GMP), CDMOs guarantee the production of safe, reliable, and consistent veterinary pharmaceuticals.

Application Insights

The medicine segment registered the highest market share of 63% in 2022. When it comes to medicines, Veterinary CROs and CDMOs are at the forefront of pharmaceutical innovation, focusing on the development and production of a wide array of veterinary drugs. These drugs are designed to address various health concerns in animals, ranging from common infections to chronic diseases. Through meticulous research and clinical trials, CROs explore new compounds and formulations, ensuring their efficacy, safety, and suitability for different animal species. Veterinary CDMOs, on the other hand, transform these research findings into tangible medicines through advanced manufacturing processes.

In addition to medicines, the Veterinary CRO and CDMO market also delves into the realm of medical devices for animal healthcare. These devices are designed to enhance diagnostics, improve treatment outcomes, and provide overall better care for animals. Veterinary CROs engage in research and development to create innovative medical devices, such as diagnostic tools, monitoring equipment, and specialized surgical instruments. Through collaborations with veterinary professionals, they refine these devices to meet the specific needs of diverse animal species.

Regional Insights

North American region dominated the animal health CRO & CDMO market with the largest revenue share of more than 31% in 2022. In North America, the market is driven by a robust pet industry, a high prevalence of pet ownership, and stringent regulatory standards. The United States and Canada, in particular, are major contributors to the market growth, owing to the significant investments in research and development activities. Additionally, the region witnesses a constant influx of innovative technologies, fostering collaborations between pharmaceutical companies, CROs, and CDMOs to create cutting-edge veterinary drugs and services.

The Asia Pacific region predicted to grow at the fastest CAGR during the forecast period. Asia-Pacific is emerging as a key market for Veterinary CRO and CDMO services. Rapid urbanization, a growing middle class, and increased pet ownership are fueling the demand for specialized animal healthcare products. Countries like China, Japan, and India are witnessing a surge in investments in research and development, with a focus on innovative drug formulations and medical devices. Additionally, the region’s strong manufacturing capabilities make it a strategic hub for CDMOs, catering not only to local demands but also to global pharmaceutical companies outsourcing their production.

Veterinary CRO And CDMO Market Segmentations:

By Animal Type

- Companion Animals

- Livestock Animals

By Service Type

- Discovery

- Development

- Manufacturing

- Packaging & Labeling

- Market Approval & Post-marketing

- Early Phase/Preclinical

- Late Phase/Clinical

By Application

- Medicines

- Medical Devices

- Pharmaceuticals

- Biologics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/40891

You can place an order or ask any questions, please feel free to contact sales@visionresearchreports.com| +1 650-460-3308